Investing For Beginners

As you age and progress through different life stages, for example, marrying, starting a family, setting aside for your children’s college fund, or preparing for life after retirement, you will hear more from well-meaning friends and family about the need to invest.

At its core, investing helps you make your money work for you, thanks to compounding interest and returns. That means the returns you earn are reinvested to earn additional returns, thereby growing over time.

If you invest RM250 at a 3% per annum interest rate, by Year 2 that RM250 will become RM257.50 (RM7.50 = 3% of RM250). By Year 3, this will compound further to RM265.23 (RM7.73 = 3% of RM257.50). Extrapolate this to larger figures, and you can see how massive the effect of a simple investment habit can have on your wealth outlook.

Rather than waiting for a major life event to impact your financial fortunes, it is better to start investing earlier, to see the benefits in the long run. Every year, you hear a familiar phrase: “My salary is the same, but prices of goods are up.” That is inflation, and the reason why simple investment tools such as fixed deposits (FDs) and pension schemes make it a point to deliver returns ‘above inflation’.

In Malaysia, 2021’s inflation rate was 2.5%. So to make your money have even the same impact in 2022 as it did the year before, your investment value had to grow by at least 2.5%. With FDs rates currently throttled at around1.5-2%, these are not viable investment tools in a low-interest rate environment.

Check your risk tolerance before investing

So what’s next, you ask? Considering investment products with higher returns (such as stocks) also means taking on more risk and volatility.

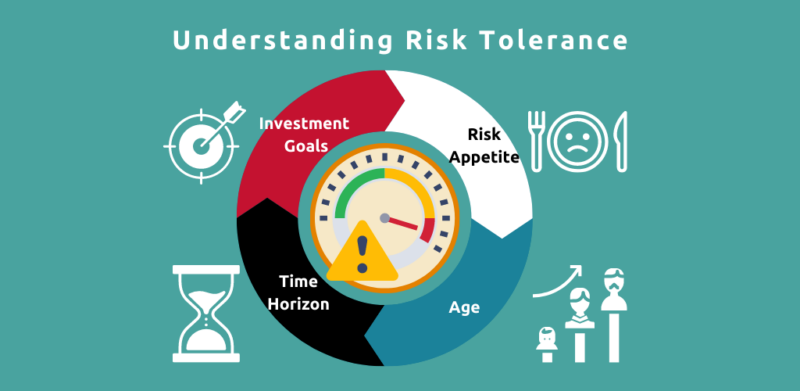

Depending on several factors, an individual investor’s risk tolerance level may differ. There are four key elements that inform risk tolerance: Investment Goals, Time Horizon, Age, and Risk Appetite.

For instance, if you are just starting out in the workplace in your 20s or 30s, you may have a higher risk tolerance as you expect your investments to be longer term.

Conversely, if you are in your 40s or 50s, it is likely that your risk tolerance will be smaller as you have a shorter time horizon with which to realise your investment goals, such as setting aside funds for your children’s education or retirement.

All four elements work in concert. To delve deeper and build your own risk profile, check out our Risk Profiling article.

Characteristics of beginner-friendly investment tools

Before diving in, first pick an investment product that is both easy to understand (i.e. no or few fees, simple tiers on returns and timelines) and has a low barrier to entry (i.e. easy sign up, lower minimum investment amount). Lastly, ensure that your selected investment product aligns with your personal investment objective and risk tolerance levels.

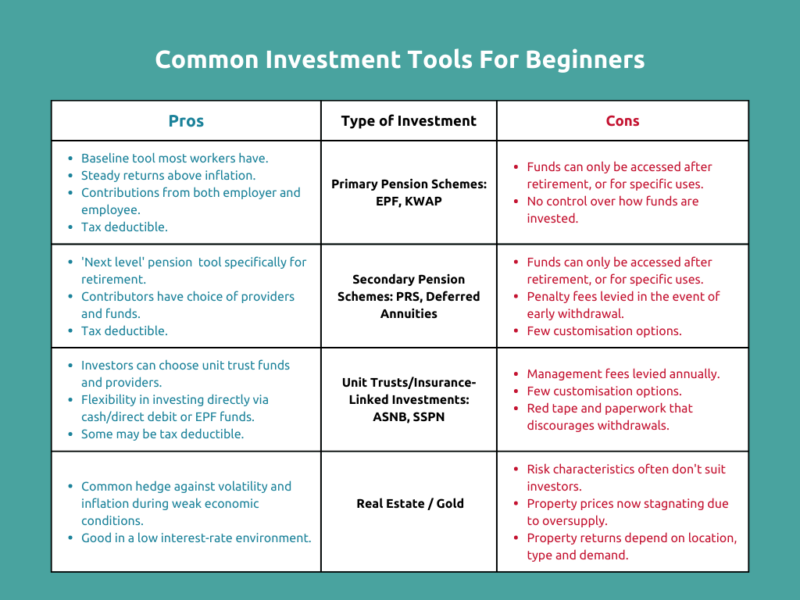

In Malaysia, there are a wide variety of investment products available to beginners, with varying risk levels, returns, and accessibility.

New options for beginners

A new entrant to the investment landscape is Kenanga Digital Investing (KDI), a fully-automated robo-advisor that leverages Artificial Intelligence to make investment decisions. Powered by Kenanga Investment Bank, KDI fulfils all three key characteristics that make it ideal for investment beginners.

First, KDI enables quick sign-ups via both its web platform and app. With a low minimum investment amount of RM250 and no fees for investments of up to RM3,000.

KDI’s no-frills approach makes it a great choice for many investors, both beginners and seasoned professionals, due to its low annual management fees, zero sales charges, no hidden fees, and no penalties.

Second, KDI offers two different products, with KDI Save acting as an FD-adjacent product offering 3% interest per annum on investments up to RM200,000.

Third, for those with stronger risk appetites, KDI Invest helps beginners invest in a basket of exchange-traded funds (ETFs) listed in the U.S. KDI Invest helps beginners calculate their specific risk tolerance level (five tiers from Very Conservative to Aggressive Growth).

Fulfilling the three characteristics for beginners, KDI Save and KDI Invest are easy to understand, easy to participate in, and are well suited to your investment needs. Click here to start investing with KDI now!