How Does KDI Portfolio and Risk Profiling Work?

Like buying a pair of shoes or getting the best haircut, there are things which are never ‘one size fits all’.

The same applies to investments; each investor has different investment goals and different behaviour towards risk, which is why we need personalised asset allocation and varying risk profiles.

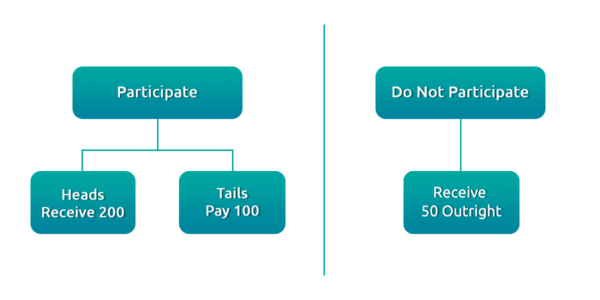

If you are offered an opportunity to play a coin flip game with the following outcomes:

Should you choose not to participate: You will avoid the risk of losing RM100 if you get tails, with a definite prize of RM50.

If you choose to participate: You are willing to take a 50/50 chance to either win a higher prize of RM200 or lose RM100. So, which did you choose? This simple example reflects your risk appetite.

The coin flip scenario is one of the more basic tests that can determine one’s risk profile. There are more methods that are used for individual risk assessment to determine the suitability of each financial product for everyone.

It is important to perform these assessments because many investment products sold in the market today may not be suitable for investors due to little, or confusing, disclosure of associated risks.

Why Is a Tailored Risk Approach Important?

Our priorities in life change as we age. If you are young, single and financially successful, a flashy sports car or the latest gaming gadgets might be high up in your must-buy list. But as you are married with kids, your financial priorities might shift to other things, like your kids’ education fund, your retirement plan, and so on.

In a way, risk management is synonymous with capital allocation. We allocate most of our capital to the investment that is most suitable for us at a certain point of time. If we are risk seekers, we allocate capital to high-risk investments in the hope of generating higher returns. On the other hand, if we have a low risk tolerance, we will allocate capital to relatively safe investments to safeguard our asset base, obtaining a lower risk-adjusted return. Our life needs at the time play a big part in making that decision.

Robo Advisors: Algorithm-driven Risk Assessment

Automated robo advisors such as KDI Invest fills the need for a personalised investment solution. KDI Invest uses proprietary algorithms to derive the appropriate asset allocation by assessing risk from multiple angles. Elements of risk assessment could include:

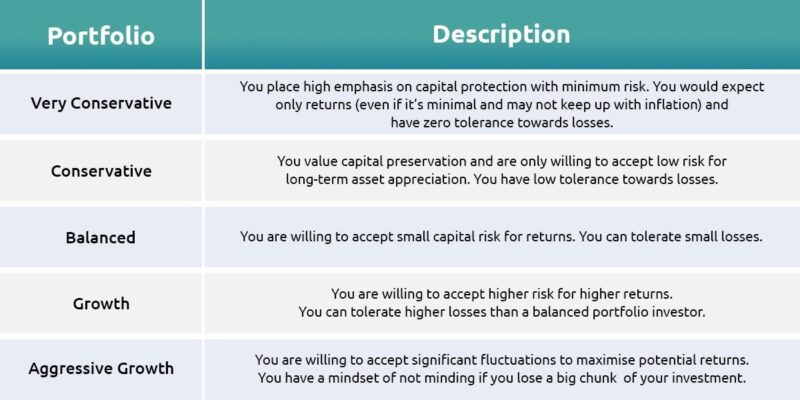

Our proprietary algorithm then segregates investors’ portfolio according to their risk profiles into 5 general portfolios:

KDI Invest: A.I. Based Portfolio Management

Our Artificial Intelligence (A.I.) based portfolio management system will integrate investors’ risk profiles and perform dynamic asset allocation based on an optimised risk-return portfolio that is unique to each investor.

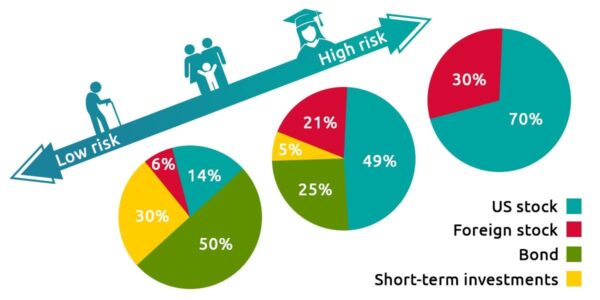

Source: Fidelity (link)

The above chart serves as an example of how portfolios might look for people with different risk profiles. A retiree may seek to preserve capital with conservative investments, while a fresh graduate can afford riskier assets that can pay off over the long term.

Beyond these considerations, our proprietary dynamic asset allocation system also takes into account the current underlying market conditions to optimise risk in its asset mix as appropriate to the client.

As an example, let us look at two types of investors: An aggressive investor with a portfolio that favours higher-risk assets such as stocks, and a conservative investor with a portfolio that favours lower-risk assets like bonds. With dynamic asset allocation, the A.I. will swiftly modify the investor’s portfolio to seek for opportunistic returns or avoid unexpected losses under certain market conditions.

In a bear market, an aggressive investor’s portfolio might avoid potential losses by investing in lower-risk assets. Meanwhile in a bull market, a conservative investor may earn slightly higher return by pivoting to higher-risk assets. All in all, dynamic asset allocation aims to maximise the potential of an investor’s portfolio across all risk preferences by taking advantage of the A.I. ‘s unbiased evaluation of market conditions.

Diversified Portfolio Exposure

KDI offers geographical and asset class diversification via Exchange-Traded Funds (ETFs) which provide better value in terms of fee structure and flexibility. ETFs across different asset classes are used to achieve A.I. computed asset allocations. Here is a selection of ETFs KDI Invest uses:

KDI Invest offers a tailor-made investment solution for customers at any stage of life. To try things out, the management fee is waived for investments of RM3,000 and below, whether you are a conservative investor who would like to start investing with smaller capital or an aggressive investor who wants to maximise your return potential. Click here to start investing today.

Citations: