Are You A Risk Taker?

The common phrase “You have to risk it to get the biscuit” implies that it is an either-or situation when it comes to going for gold. However, in terms of investing, this is too simplistic a view. Kenanga Digital Investing (KDI) believes that every individual investor has diverse risk characteristics that inform their investment style.

As such, KD’s proprietary algorithm segregates investors’ portfolios according to five different risk profiles: Very Conservative, Conservative, Balanced, Growth, and Aggressive Growth.

Four key characteristics can help investors hone in on their risk profile: time horizon, age, investment goals, and risk appetite. While you may be able to identify the first three characteristics, this article will help you determine your risk appetite level.

Traits of a Risk Taker

Risk appetite is fluid, perhaps more so than the other three characteristics. It very much depends on your personal experiences, character, and decision-making process. For instance, you may be a risk taker in your 20s or early 30s, but once you start a family or have dependents, your decision-making may turn more cautious.

Generally, this is how a cautious personality matches up against a risk taker. Your risk appetite may place you anywhere between these polar opposites, and guide your investment strategy.

How Your Risk Appetite Translates To Your Investment Strategy

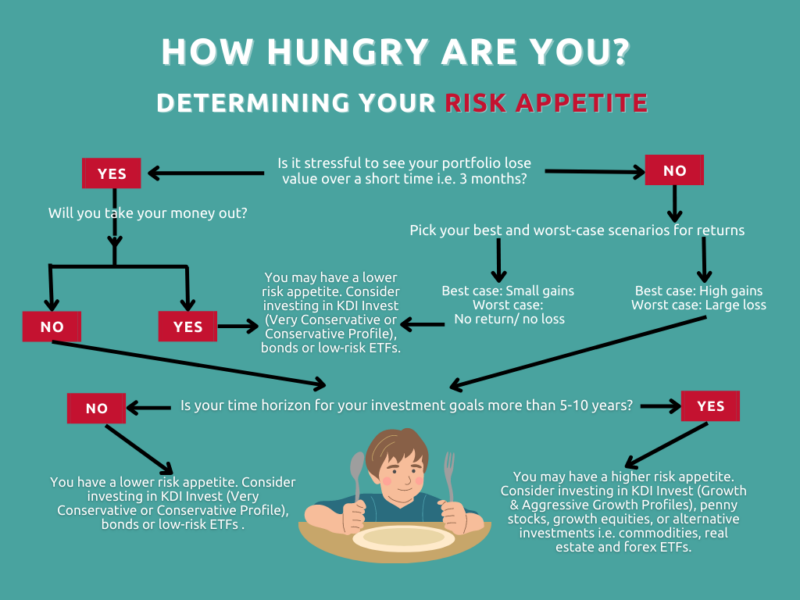

Now that you have identified what sort of traits you have, here is a quick guide to help determine your risk appetite, and then put that in an investment perspective. This will then inform how you allocate assets or construct your investment portfolio.

How Do Risk Takers Invest?

If you are indeed a risk taker with a big appetite and strong heart for high-risk investing, there are two common themes that emerge when building a high-risk portfolio the way hedge funds or other adventurous institutional investors do.

The first theme is momentum investing. You may have heard of the maxim “Buy low, sell high.” In reality, this is hard to pull off consistently. High-risk investors that practise momentum investing typically buy stocks that are already seeing prices on the upswing. These investors tend to believe that the stock still has room to grow, and thus want to catch a ride.

One example is Ark Investment Management’s belief in the electric vehicle company Tesla (TSLA). Tesla’s share price has skyrocketed from around US$80 in late 2019 to over US$700 per share today. Ark has continued to buy Tesla’s shares, and Tesla now represents almost 8% of the Ark portfolio. Despite the massive gains already, Ark believes Tesla’s share price will keep booming to US$4,600 by 2026.

Momentum investors can become too hyped up on buying that they become stubborn to sell. This calls for strong sell discipline – something even seasoned investors may lack due to the emotion involved. One strategy is to set a price for when you believe momentum fades (stop-loss). For instance, if you buy a share at RM100 and you see it rise to RM300, you can set a stop-loss order to sell the share if it dips back down to RM250.

The second theme of high-risk portfolios is concentrated investing. Investors that practise this style of investing are equally strong believers – but instead of believing and doubling down on a single company, they concentrate their investments into a single sector or industry.

Concentrated investing calls for investors to have in-depth knowledge and understanding of past trends in the sector they believe in. Benchmark Brent Crude Oil (BZ) nosedived to US$19 per barrel in April 2020 from (October 2018: US$84) when the coronavirus pandemic shut down global travel and transport activities, creating more supply than demand for the commodity.

Concentrated investors bought oil-related shares at historically low prices and were willing to sit on these shares for a while. Within two years, Brent crude prices had recovered to US$118 following widespread vaccine rollout and resumption of tourism and travel worldwide.

Outside of black swan events, many concentrated investors continue to buy and sell on single-sector cycles, such as crude palm oil futures seasonal ups during festival seasons (high demand for cooking oil and household goods) and downs during the rainy seasons or when production is high.

Other high-risk portfolios also may feature risky, volatile assets such as penny stocks (defined as below US$1 or RM1 per share), forex (foreign currencies), options, and shares in emerging market assets i.e. bonds in South America or equities in Vietnam.

How KDI Invest Helps Risk Takers

Both momentum and concentrated investing calls for strong discipline by investors to sell stocks when momentum starts to fade and cycles turn. However, even professional fund managers are human and find it hard to pull away from a sector or company they so strongly believe in.

KDI Invest solves this bias by taking emotion out of the equation entirely. The robo advisor’s proprietary AI algorithm will automatically rebalance portfolios and pare down stocks in response to market movements such as global macroeconomic trends. This helps cut downside risk, and eventually the system automatically reallocates investments to other stocks or sectors on the upswing.

Due to the data-rich environment of U.S. Exchange Traded Funds (ETF), KDI Invest’s automated portfolio manager can ensure that a risk taker’s portfolio is still diversified while delivering value gains. The wide variety of U.S. ETFs cover high-yield emerging market bonds, futures, options, commodities, currencies, and even narrows down focus on specific sectors or sub-sectors.

By taking into account macroeconomic movements (such as the Ukraine-Russia war) impact on sectoral ETFs, KDI Invest can quickly pivot to a different asset or sector to take advantage of undervalued assets while staying true to an individual investor’s defined risk profile and appetite. Click here to tell us which of KDI Invest’s five risk profiles fit you best and start your investment journey today!