December 2022 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 11th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

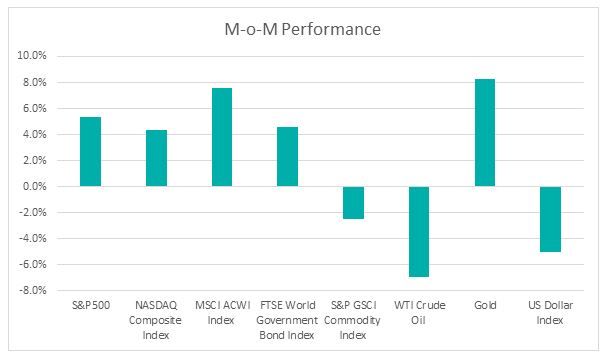

Chart 1: Index Performance in November 2022

Market

The month of November ended on a high note as the S&P500 and Nasdaq composite gained 5.6% and 4.4% respectively. The better-than-expected inflationary data and corporate earnings helped boost equities indexes posted a second consecutive month of gains. The US inflation jumped 7.7% y.o.y. in October. The increase was below economists’ expectation of 7.9%. The inflation rate decreased from June’s 9.1% pandemic-era peak and September’s 8.2% reading.

The 10-year treasury yield decreased from the October peak of 4.24% to 3.60%. The 2-year Treasury yield touched 4.71% but pulled to 4.31% at month’s end. The yield curve remains inverted, with the two-year Treasury yield higher than the 10-year Treasury yield. The gap between the 2-year and 10-year treasury yields was at its most inverted level since 1981.

The S&P GSCI Index pulled back 2.5% with WTI oil price tumbled this month, unravelling the gains made in October after the Organization of Petroleum Exporting Countries (OPEC) and its allies decided to reduce oil production. The OPEC signalled that it would consider deeper oil output cuts during its upcoming meeting in December after slashing production by 2 million barrels per day in October. The OPEC expects weakening crude demand in the near term due to increasing economic uncertainty fuelled by rising interest rates and high inflation.

The US Dollar Index declined 5% to 105.95 in November, dipping to 16-week lows against a basket of major currencies on the prospect of slower rate hikes from the Federal Reserve and signs of cooling inflation.

Outlook

The US Federal Reserve approved a fourth consecutive three-quarter point interest rates increase to 3.75% – 4% after its FOMC meeting in early November. US Inflation cooled in October by more than forecast, giving Federal Reserve officials room to slow down their steep interest-rate hikes. US Fed chairman Jerome Powell said that the US Federal Reserve may slow down the pace of further tightening. The fed rates may reach a higher-than-expected terminal rate as the US Fed still had some ways to go to taming inflation. The markets have been rallying in anticipation that the US central bank is likely to slow hikes to 50 basis points at its December meeting.

IMF said the global economic outlook is getting gloomier than projected, citing a steady worsening in purchasing manager surveys in recent months. The recent purchasing manager indices, the leading indicator of the economy, signalled weakness in most groups of 20 major economies, with economic activity set to contract while inflation remained stubbornly high.

China’s factory output grew more slowly than expected and retail sales unexpectedly dropped in October, suggesting the world’s second-largest economy is losing momentum as it struggles with protracted Covid-19 curbs and a property downturn. The People’s Bank of China (PBOC) reduced the reserve requirement ratio for most banks by 25 basis points to around 7.8% amid the weakening economy. The adjustment will inject 500 billion yuan of long-term liquidity into the economy and takes effect on 5 December 2022. Beijing also rolled out more stimulus measures targeting the real estate sector, which supported sentiment toward the country and boosted China stocks.

Going forward, global growth will continue to face headwinds on tightening monetary policy triggered by persistently high and broad-based inflation, the risk of global recession, and ongoing supply disruptions and food insecurity caused by Russia’s invasion of Ukraine.

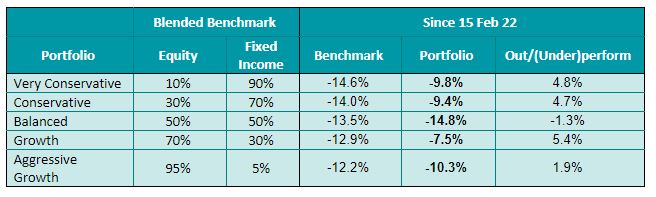

KDI Invest Portfolio Performance As at 31 November 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since their launch on 15 February 2022. The portfolio returns are ranging from -7.5% to -14.8%. The portfolio out/(under)performances versus the benchmark are ranging between -1.3% and 5.4%.

With the early signs of market stability with the CBOE Volatility Index falling to its lowest level in more than three months, the KDI A.I. increases the risk of selective portfolios by allocating higher equity exposure. The equity exposures of the portfolios are ranging from 19% to 29% and are diversified into the US, Europe, and Asia regions. The main exposure includes Vanguard Total Stock Market Index (VTI), Vanguard 500 Index Fund ETF (VOO), and Vanguard Developed Markets Index Fund ETF (VEA).

The investment strategies of selective portfolios remain defensive with weighting towards fixed income with allocation mainly in short-duration bonds and high-quality government bonds. The main holdings include iShares Short Treasury Bond ETF (SHV) and iShares 7-10 Year Treasury Bond ETF (IEF).