December 2023 Market Insights

Welcome to the December edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

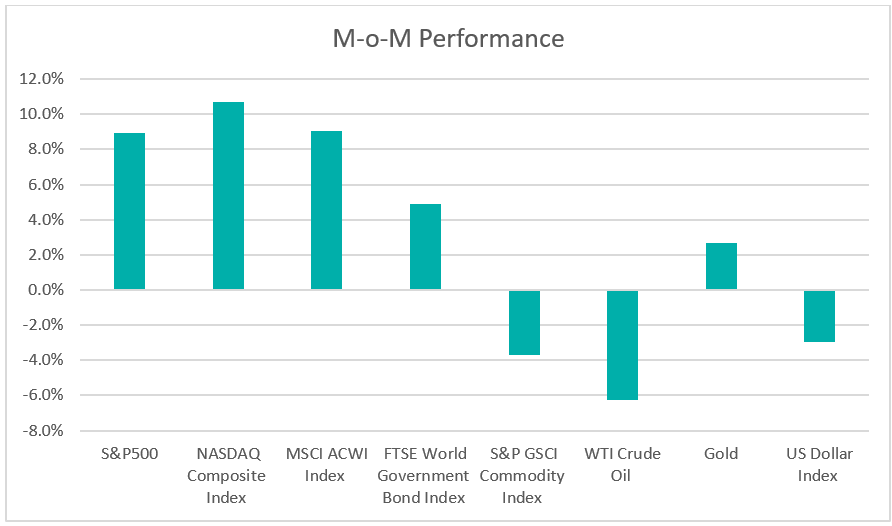

Chart 1: Index Performance in November 2023

Market

Equities surged in November, with the S&P 500 and Nasdaq gaining 8.9% and 10.7% respectively, marking their largest monthly gains since July 2022. The MSCI ACWI Index rebounded by 9.1% after three months of decline, attributed to reduced inflation concerns and signals from central banks suggesting a conclusion to the interest rate hike cycle.

Within the fixed income realm, US Treasury yields experienced a retreat from their highs. The two-year Treasury yield plummeted by 40 basis points to 4.6802%, while the ten-year Treasury yields declined by 60 basis points to 4.3264%. This decline was triggered by speculation about the Federal Reserve potentially considering rate cuts in the coming year.

The S&P GSCI Commodity Index witnessed a decrease of 3.7% within the month. Oil prices continued their decline from the previous month after OPEC+ declared an additional 2.2 million barrels per day (bpd) production cut slated for the first quarter of 2024. This decision was seen as an indicator of deteriorating economic conditions that could potentially reduce global crude demand. In contrast, gold prices surged above $2000, marking their second consecutive monthly increase.

In contrast, the dollar faced downward pressure as US treasury yields declined during the month. This drop led the US dollar index to settle at a three-month low of 103.5 points.

Outlook

The US economy experienced strong growth in the third quarter, with the GDP surging by a revised 5.2%, marking its quickest pace in nearly two years. Inflationary pressures decreased, as indicated by the latest Consumer Price Index data from the Bureau of Labor Statistics. The data showed a 3.2% rise over the 12 months ending in October, down from 3.7% in September, representing the lowest annual rate since March 2021. November saw an improvement in US consumer confidence, the first increase in four months, driven by positive expectations in the job market. Moreover, a robust job market, leading to increased real wages, empowers individuals to sustain their spending levels.

China’s economic landscape depicts a mixed scenario of strengths and weaknesses as of late 2023. Industrial output surpassed expectations, growing at 4.6% in October, while retail sales climbed by 7.6%, accelerating from September’s 5.5% growth. However, the manufacturing and services sectors faced contraction in November, highlighting the need for further government support. The People’s Bank of China (PBOC) injected 1.45 trillion yuan into the financial system through its medium-term lending facility, emphasizing support for the economy amid struggles. Foreign investor confidence in Chinese stocks wavered, indicated by the continued pullout from Chinese onshore stocks for a fourth straight month in November. While challenges persist, optimism remains regarding a potentially brighter outlook for China in 2024, given early signs of stabilization.

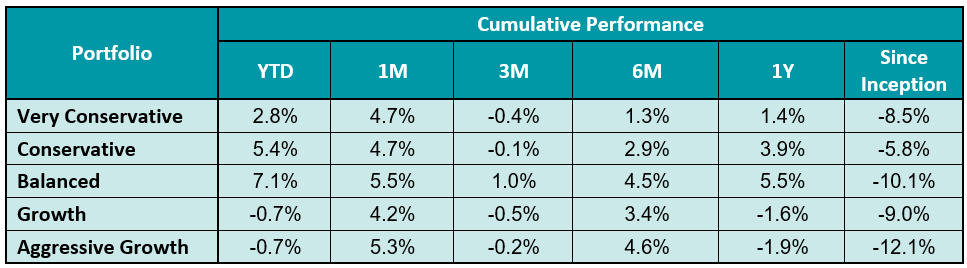

Table 1: KDI Invest Portfolio Performance As at 30 November 2023

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. Year-to-date, all portfolios have recorded returns within a range of -0.7% to 5.4%.

The global economy has exhibited more resilience than anticipated in 2023, attributed to solid US economic growth, easing inflation pressures, and central banks implementing less aggressive tightening policies than initially forecasted. Volatility in US stocks has decreased to levels similar to those before the pandemic, while S&P500 has seen a 19% year-to-date increase. Notably, the market performance in the US has been significantly driven by the seven mega-cap technology stocks.

Treasury yields have significantly increased in the past two years due to aggressive rate hikes. Although central banks in developed markets have paused their rate hikes, policy rates are expected to remain high for an extended period, contributing to stringent financial conditions. Investors are now awaiting confirmation from cooling inflation data and potential rate cuts in 2024. The growing possibility of a recession supports investment in bonds. Furthermore, changes in global economic conditions could potentially lead to increased market volatility, uncertainties in global economic growth, interest rates, and geopolitical events. In such a scenario, diversification becomes crucial, as these shifts may present opportunities to establish long-term positions. Assets such as gold and commodities could serve as safeguards against geopolitical risks and inflation.

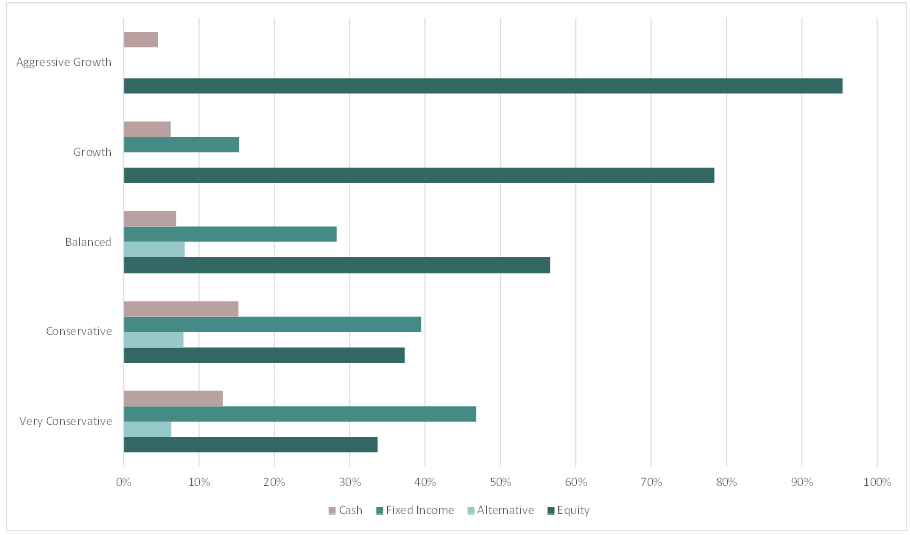

Chart 2: Asset Class Exposure As at 30 November 2023

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://edition.cnn.com/2023/11/14/economy/consumer-price-index-october/index.html