February 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 13th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

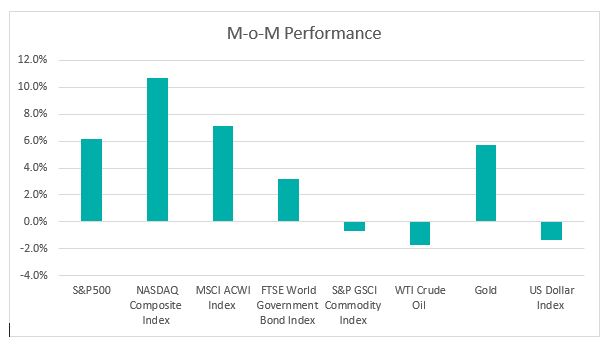

Chart 1: Index Performance in January 2023

Market

Global equities began 2023 on a strong note, with the S&P 500 gaining 6.2% to reach 4,076.60 points, and the Nasdaq Composite surging 10.7% to 11,584.55 points. The rally was driven by easing inflationary pressures, which sparked hopes for a policy shift from the Federal Reserve.

In January, the easing of inflation and the pursuit of income boosted the performance of bonds, resulting in the FTSE World Government Bond Index rising 3.2% for the month. The US 2-year and 10-year Treasury yields fell by 20-40 basis points, contributing to positive returns for the bond market. Both the 2-year and 10-year Treasury yields were 4.4258% and 3.8748%, respectively, and the yield spread between the two-year and 10-year notes was minus 69 basis points.

Commodity prices were mixed, with the S&P GSCI Commodity Index declining slightly by 0.7% over the month. WTI crude prices closed at around $78.87 per barrel, while gold prices edged up, hitting a nine-month high on January 26, 2023, before stabilizing as investors prepared for US economic data that could impact the Federal Reserve’s policy tightening path.

The downward trend for the US dollar continued, weakening against most major developed and emerging market currencies. The dollar index, which tracks against six major currencies, including the euro, yen, and British pound, decreased by 1.4% to 102.10. Investors generally expect the Fed to raise interest rates by 25 basis points, a decrease from a 50 basis points increase in December 2022.

Outlook

US inflation continued to slow in December, providing further evidence that price pressures have peaked and putting the Federal Reserve on course to slow the pace of interest rate hikes. The overall consumer price index decreased by 0.1% from the previous month, with energy costs posted the first decline in 2.5 years. The core Consumer Price Index (CPI) increased by 0.3% month-over-month and was up 5.7% year-over-year, the slowest pace since December 2021. With slowing inflation in the US keeping the Fed on track to slow its pace of rate hikes in its next meeting, investors are anticipating a more gradual pace of rate hikes by central banks.

The focus remains on the US corporate earnings season. To date, 50% of the companies in the S&P 500 have reported their actual results for Q4 2022. Out of these companies, 70% reported actual earnings per share (EPS) that exceeded estimates, and 61% reported actual revenues that were above estimates.

Since the S&P 500 reached an all-time high a year ago, the index’s price-to-earnings ratio has fallen over 20% from its peak, reaching levels closer to historical averages. The forward 12-month price-to-earnings (P/E) ratio is 18.4x, which is below the 5-year average of 18.5x, but above the 10-year average of 17.2x, according to FactSet.

The US labor market continues to see solid gains, and better-than-expected economic growth in the last quarter has eased worries about a severe recession. The US economy grew faster than forecast at the end of 2022, with GDP increasing at a 2.9% annualized rate in the fourth quarter of 2022, following a 3.2% gain in the third quarter of 2022, according to the initial estimate from the Commerce Department.

China’s shift away from its zero-COVID policies and the implementation of a new pro-growth policy are expected to boost economic activity in the coming quarters. The International Monetary Fund has revised its forecast for China’s GDP growth in 2023 to 5.2%, a significant increase from its previous prediction of 4.4% in October 2022.

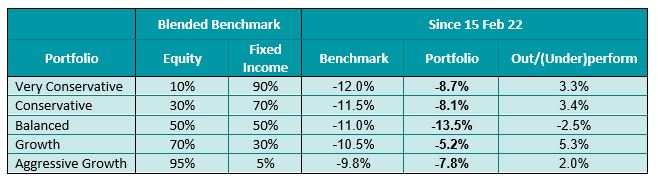

KDI Invest Portfolio Performance As at 31 January 2023

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The table above displays the performance of selected KDI portfolios since their launch on February 15, 2022. The returns on the portfolios, measured in USD, vary from -13.5% to -5.2%. The outperformance or underperformance of the portfolios compared to the benchmark ranges from -2.5% to 5.3%.

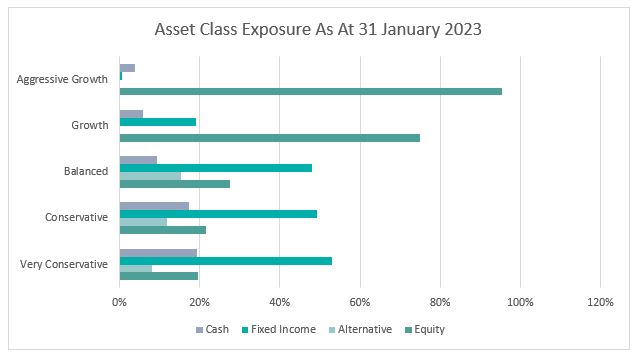

As the inflationary pressure has started to ease and the job market remains healthy, a rebalancing was triggered in early January 2023. The equity exposure of the portfolios is currently between 19% and 95%. The Very Conservative and Conservative portfolios are heavily weighted towards fixed income with exposures ranging from 49% to 53%. The portfolio strategy remains intact, with investments in a mix of assets and a global diversification approach. All portfolios are tailored to each investor’s risk tolerance, enabling them to weather market volatility.

Please note that the above performance is based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.

Citation:

https://insight.factset.com/sp-500-earnings-season-update-february-3-2023