February 2024 Market Insights

Welcome to the February edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

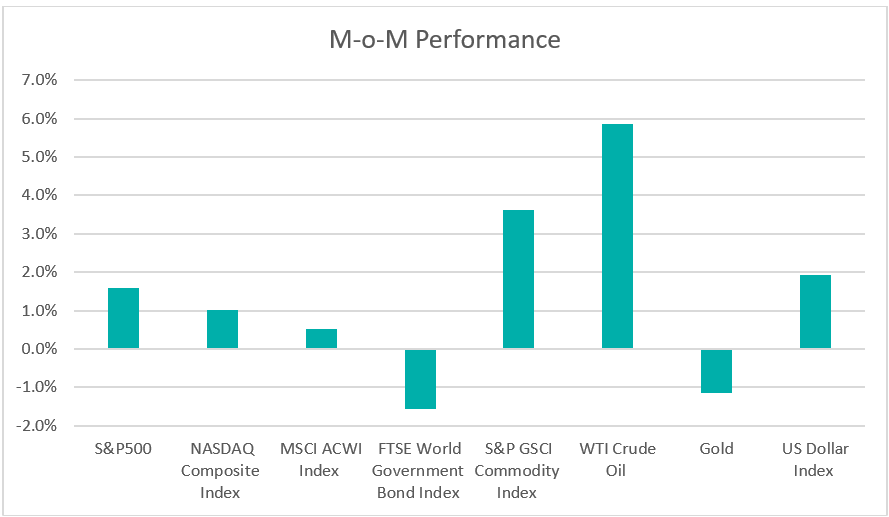

Chart 1: Index Performance in January 2024

Market

In January 2024, all three primary US stock indices recorded gains, with the S&P 500 setting another record closing high. The rally was spearheaded by US Megacap stocks, as investors actively sought indications of potential upcoming rate cuts in the US. Concurrently, investors evaluated corporate earnings, anticipating faster growth in the fourth quarter of 2023 earnings. The MSCI’s All Country World Index also saw significant activity, hitting a new two-year peak, closing the month with a 0.5% increase.

In fixed income, the 10-year U.S. Treasury yield dipped below the key 4% level, closing at 3.9124 during the month. Investors had been expecting a possible rate reduction or the initiation of a rate-cutting cycle at the March meeting. However, Federal Reserve Chair Powell emphasized that an interest rate cut was unlikely at the March meeting, given that inflation remains above its targeted 2% goal.

The S&P GSCI Commodity Index experienced a notable 3.6% increase over the month, accompanied by a significant surge of 5.9% in oil prices. Ongoing concerns in the Middle East intensified due to repeated attacks on Red Sea shipping lanes, a vital route for transporting energy resources, particularly oil and natural gas, from the oil-rich Middle East to various global markets. Meanwhile, gold exhibited relative stability but saw a modest decline of 1.1%, settling at $2062.98 per ounce for the month.

The US dollar index rose by 1.9% to reach 103.27. This uptick can be attributed to the extent of Federal Reserve (Fed) rate cuts factored into the markets and increased demand for the safe-haven currency due to geopolitical tensions.

Outlook

In December 2023, the US Personal Consumption Expenditures (PCE) price index saw a 0.2% increase. Similarly, the Core PCE price index, a key inflation metric monitored by the Federal Reserve to achieve its 2% target, also rose by 0.2%, showing a 2.9% year-on-year gain. Following the Federal Open Market Committee’s (FOMC) announcement of maintaining the policy rate between 5.25% and 5.5%, investors have shifted their expectations for the Fed’s first rate cut from March to May. The FOMC signaled that a rate cut in March is unlikely. Meanwhile, the labor market continues to show resilience, maintaining a relatively healthy state with an unchanged unemployment rate of 3.7% in January compared to December.

The post-pandemic recovery in China has been uncertain due to challenges in the housing market, risks associated with local government debt, and a decline in global demand. This uncertainty has dampened momentum, impacting investor sentiment at the beginning of 2024. The sell-off in Chinese stocks has intensified, marking their weakest start since 2019. Weak manufacturing and home sales data have heightened investor concerns about the economic outlook. According to the National Bureau of Statistics (NBS), the official Manufacturing Purchasing Managers Index (PMI) for January 2024 stands at 49.2, remaining below the critical 50-mark that distinguishes expansion from contraction. In response to these challenges, the People’s Bank of China (PBOC) has implemented a significant 50 basis points (bps) reduction in the reserve requirement ratio (RRR) for all banks, marking the most significant reduction in the past two years, signalling robust support for the fragile economy and the declining stock markets in the country.

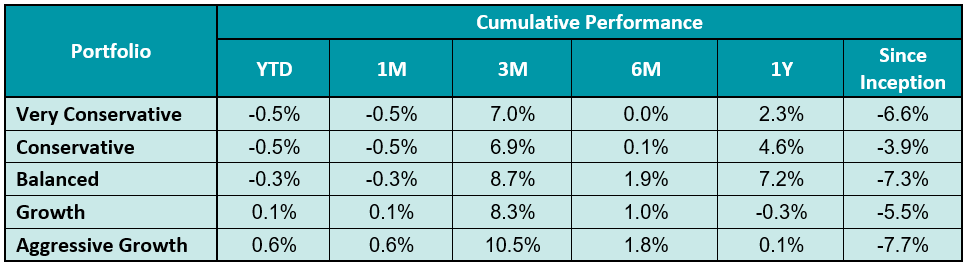

Table 1: KDI Invest Portfolio Performance As at 31 January 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from –7.7% to -5.5%. In January 2024, all portfolios recorded returns within a range of -0.5% to 0.6%.

A combination of mixed economic data and signs of easing inflation has prompted central bankers to open the door to rate-cut speculation. Growing optimism about potential Federal Reserve interest rate cuts has encouraged investors to overweight US stocks. Major central banks, including the Federal Reserve and the European Central Bank, are anticipated to implement rate cuts later this year as inflation moderates, potentially resulting in lower yields in the bond market. Additionally, geopolitical tensions in the Middle East and the upcoming US presidential election in November are anticipated to drive investor confidence going forward.

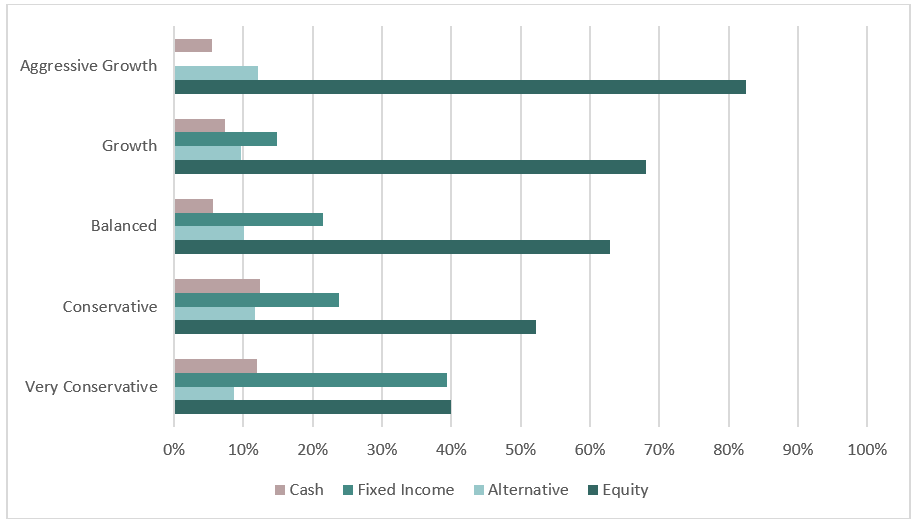

The KDI portfolios maintain diversification to ride through market volatility, with current allocations to equity ranging from 43% to 83%. Fixed income constitutes an allocation of up to 39%, while alternative investments, primarily in the gold ETF (GLD), make up to 12% of the portfolio. Cash holdings range from 5% to 12%.

Chart 2: Asset Class Exposure As at 31 January 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.