How Much Money Do I Need To Start Investing?

Every year, new investment products are introduced across the globe. Once, a typical retail investor would have been content to invest in local stocks and in fixed deposit accounts linked to their savings accounts. Today, the modern investor is assailed by advertisements ranging from specialised public-traded products such as equity-traded funds, cryptocurrencies, and even risky peer-to-peer platforms.

Many investors are increasingly aware of the importance of investing on top of simple savings, but simply do not know where to start. A 2019 survey found that despite 90% of Malaysian millennials having disciplined budgeting strategies, many have little to no knowledge on how to invest their money.

If you are a digitally-savvy user bombarded by questionable investment advertisements on social media, it’s important to start at the basics: finding the right time to invest, why invest, and finally, arrive at the conclusion of how much to invest.

Right time to invest

In Article 11, we previously discussed three angles relating to the use of your cash: spending, saving, and investing. From your monthly income, after spending to meet your needs, this excess cash can be divided up for savings (i.e., putting aside money for emergencies or a rainy-day fund) and then investment (i.e., putting money etc. into something to make a profit or to build an advantage).

The Hierarchy of Financial Needs can help novice investors figure out where they fit in the investment sphere:

As illustrated, the bottom tier of the pyramid is the Spending Tier and the one above that is the Saving Tier, with the top three tiers being Investment Tiers. It’s simple: savings takes priority over investment. And within the investment family of products, choosing an investment tool or option will depend on where an investor is at their point in life, or path towards their investment goals.

Why invest?

Those new to investing are typically conservative or risk-averse, choosing to ‘conserve’ or save funds in instruments such as fixed deposits (FDs) that offer guaranteed income at very low interest rates from 1.5-2%.

Conservative investors who put all their savings – and investments – in FDs often end up with massive amounts of six- or even seven-digit figures in their FDs, losing out on potential gains from better-earning instruments while barely keeping up with inflation.

Other investors might point to pension schemes, such as the Employees Provident Fund (EPF), which has traditionally targeted returns of ‘inflation + 2%’, which resolves the inflation risk previously mentioned. This puts EPF earnings in the higher range of 5-6% annually. However, the majority of savings cannot be unlocked until the investor has reached retirement age.

In both scenarios, investors are essentially locked in for a set period of time, with low but steady returns with a view to setting themselves up for retirement. However, as the Hierarchy of Financial Needs shows, investment needs extend beyond financial security. Thus, investing excess funds in better returns can help one achieve more life goals such as earlier retirement, larger inheritance for future generations, and even increased donations for causes close to one’s heart.

How much to invest?

This brings us to the final question: how much money do you need to start investing? This is informed by two variables: (1) how much you can spare (2) what you can invest in.

How much an individual investor can spare for investment needs depends on how much excess income they see each month, after setting aside sums for expenses and savings. The amount can vary from person to person depending on the number of dependents, monthly car or housing loans, and of course, income levels.

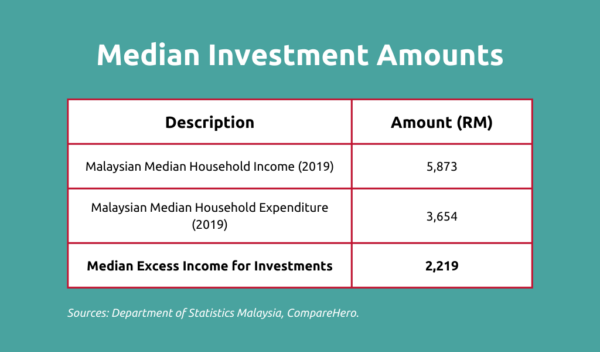

For instance, looking at the median figures above, a Malaysian household earns a collective RM5,873 in income every month. Of that figure, RM3,654 is spent on rent/petrol, food and groceries and daily expenses, leaving RM2,219 to be saved and/or invested.

Once you’ve figured out the amount of money to set aside for investments, you can start exploring the different investment products. You may already be investing by owning a house or paying monthly insurance premiums, as these can also generate a return just like stocks.

However, a savvy investor aims to maximise their return on a limited amount of capital – not merely opting for the safest, low-interest route like many of these instruments provide. In that sense, not all investments are equal. Sometimes, if the market conditions allow, investors can make better use of opportunistic investments compared to the ‘safe havens’ of gold or real estate, as discussed in our article on investing excess cash.

KDI Invest: An Investment Primer for Beginners

Rather than casting their lot with a single investment product or limiting themselves to investments in a single geography, investors can diversify their investment portfolio with Kenanga Digital Investing (KDI) Invest, a fully-automated Artificial Intelligence-driven robo-advisor that invests in a basket of U.S.-based equity-traded funds (ETFs).

Via ETFs, KDI Invest enables customers to start immediately investing in diverse global asset classes according to their individual risk appetites and profiles.

Investors can dip their toes in the investment pool with low risk but nonetheless higher returns than FDs. KDI Save offers 3% for up to RM200,000, while KDI Invest offers attractive return rates, customised to your risk appetite.

At the same time, the fully-digital nature of the platform provides a low barrier of entry, with minimal entry requirements from as low as RM250 and zero fees for portfolios up to RM3,000.