Is ‘Meme Stock’ Investing for You?

The internet is one of the most effective resources in turning an idea into a million dollar business. But, the internet can also be fertile ground for seemingly silly ideas to grow to proportions that are hard to ignore.

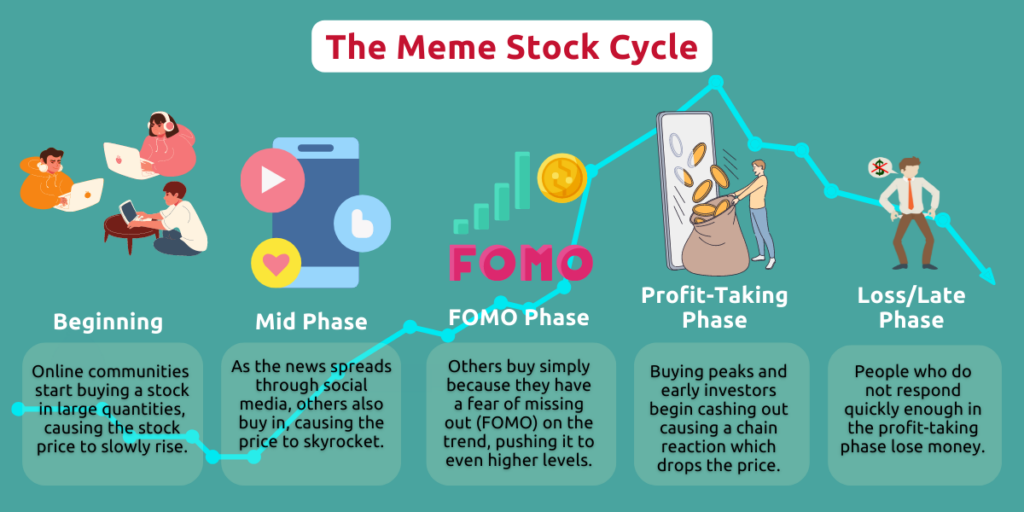

One such example is the ‘meme stock’ , a term that has recently entered our cultural lexicon. Meme stocks are shares of a company that have gained a cult-like following online and via social media platforms. The stocks gain popularity through discussion forums like Reddit, spread through social media platforms to other users who become interested and begin buying the stock. Rarely are the stocks in question valuable or reliable assets.

The online communities that generate interest in them coordinate the buying and selling as a way to influence the stock price. It is because of these communities’ influence that the stock price rises and remains elevated regardless of the actual stock or company worth.

In essence, meme stocks are fads. Few fads are lasting. While it is possible for you to make money by investing in a meme stock, it is an extremely risky investment and requires a level of speculation that is equivalent to gambling.

Sometimes, the call of high revenue can make the song of caution faint. Some people have made startlingly high amounts of money from meme stocks, and if you are in those Reddit forums, it can be hard to resist the lure.

But keep in mind that confirmation bias could be clouding your judgement. Risky stocks are rarely good for your long-term plans and losing big can put a dent in your portfolio that you may need to spend years recovering from, which can also impact future wealth generation.

The people who did well with meme stocks did so because they were on the front lines of the online communities that began the venture. They had the up-to-date information needed to buy and sell at the right time. Even then, it was a risky choice as timing the market is notoriously difficult even for those who have decades-long careers on Wall Street.

If you do not have the time or the internet savvy to follow the online communities that turn stocks into meme stocks, you have to guess which stocks will take off. At that point, you are gambling with both your current and future finances.

A fund just for fun

Some people like making risky moves. They enjoy the thrill of speculation and simply advocating prevention is not going to stop them. If you’re young and have the financial capability or potential for recovery then why not take a leap of faith?

Naturally, there is a smart way to take risks like this and that is to create a fund specifically for the purpose of making risky investments. This way you are not risking your entire financial portfolio and can keep the youthful desire for risky investments manageable by only gambling what you can afford to lose.

The idea of speculating in a smart way is an oxymoron at best, as smart investing relies on having a margin of safety. Risky investing throws away the margin of safety in favour of thrill. The thrill comes from knowing you have taken a gamble, and it is a gamble because there is a higher likelihood of losing than gaining.

However, if you create a fund for speculation, you need to be prepared to consider that fund as money you have already lost. This minimises the emotional impact if your meme stock investing does not pan out.

Before you begin this fund, ask yourself the following questions:

- Is some aspect of my life triggering a desire to act rashly (loss of job/divorce)?

- Do I have to divert any monies meant for necessities such as rent or bills to make this speculation fund a reality?

- Do I have a significant enough amount of debt that creating this fund would delay paying off that debt?

If your answer to even one of these questions is ‘Yes’, then you are not currently in a financial position where you should be speculating.

KDI: Your long and short-term strategies

KDI Save can function as a short-term strategy towards helping you form your speculation fund. With guaranteed competitive daily returns, you can slowly grow the money you feel comfortable using to speculate but will not hurt your overall portfolio or quality of life in the event of a loss.

KDI Invest is your long-term strategy to avoid allowing speculation to throw off your long-term wealth generation plans. This robo-advisor invests in exchange-traded funds (ETFs) in the U.S stock market.

Your speculation money’s potential to hurt your long-term future is significantly reduced because of your “safe pot” in KDI Invest, which is monitored and managed 24/7 by an artificial intelligence. This robo advisor takes your risk profile into consideration when it responds quickly to any changes in the market data or news points.