January 2024 Market Insights

Happy 2024! As we embark on a new year brimming with opportunities, we are delighted to present the January edition of the Market Insights column, brought to you exclusively by the Kenanga Digital Investing (KDI) team. In this edition, our esteemed Head of Digital Investing, Cheong Yew Huan, returns to discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap for 2023

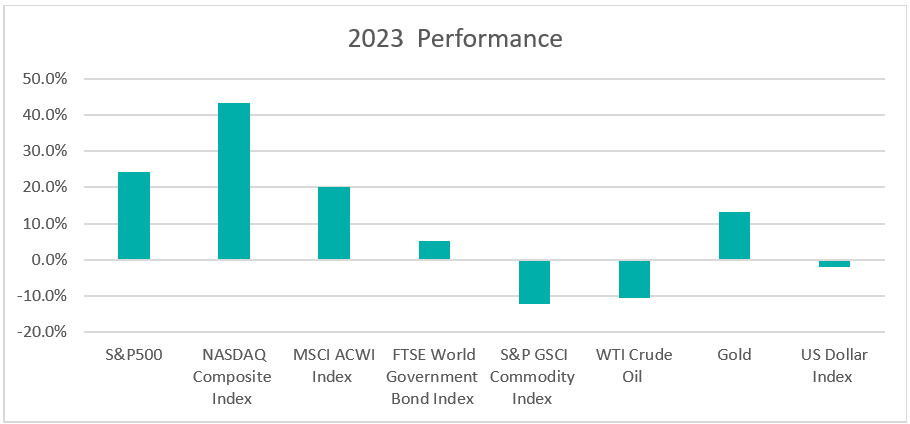

Chart 1: Index Performance in 2023

Market

In 2023, following a challenging 2022, both the stock and bond markets made a strong comeback. The S&P 500 and Nasdaq surged by 24.2% and 43.5%, respectively, with the MSCI ACWI Index gaining 20.1%. Seven mega-cap tech companies, known as the ‘Magnificent Seven’ – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla – significantly contributed to the resilience and performance of the US stock market. Despite rising interest rates, the US economy remained robust with low unemployment. Over the final two months, US stocks surged, trading near all-time highs, as inflation eased, sparking optimism about potential Federal Reserve interest rate cuts.

A notable event in 2023 was the 10-year US Treasury yield, surpassing 5% in October for the first time since 2007, though it later retreated to 3.8791% over the last two months. The central bank’s aggressive actions pushed Treasury rates higher, but yields declined later due to investors anticipating a sustained global decrease in inflation, prompting expectations of interest rate cuts by central banks next year.

The S&P GSCI Commodity Index experienced a 12.2% decline, primarily influenced by oil price volatility. Oil underwent a turbulent period, facing downward pressure due to global economic concerns but also rising due to geopolitical tensions affecting supply. Despite OPEC+ implementing production cuts, crude prices fell by 10% overall. In contrast, gold prices surged by 13%, surpassing $2,000 per ounce. Geopolitical tensions and a weakening US Dollar drove this spike, making gold an attractive investment and a hedge against uncertainty.

The US dollar experienced a decrease of approximately 2% in 2023, following two years of robust growth. By December, the dollar reached a four-month low, influenced by the US central bank’s indication of a pause in interest rate hikes.

Outlook

Over the past two years, central banks have taken aggressive measures to combat inflation by raising interest rates. However, this phase of rising interest rates is drawing to a close as policymakers shift their focus towards supporting their economies. Investors are closely watching for the Federal Reserve’s potential timing of interest rate cuts. If inflation continues to decline more rapidly than anticipated, Federal Reserve policymakers are likely to further lower rates to sustain economic growth.

China’s economy has faced challenges this year in achieving a robust recovery after the pandemic. Recent economic data reveals that China’s recovery is still challenging due to weak demand and a lingering property crisis. Despite initial optimism when Beijing ended its zero-Covid policy, Chinese markets performed below expectations in 2023

Looking ahead to 2024, several key drivers are anticipated to influence market dynamics:

• Central bank policies: The easing of inflation could potentially lead central banks to move away from rate hikes and consider initiating rate cuts. These decisions made by central banks regarding interest rates will significantly impact market confidence. Lowering interest rates might stimulate borrowing and spending, potentially fostering economic growth.

• Corporate earnings: Strong corporate earnings generally correlate with higher stock prices, signifying healthy business operations and growth potential. Investors closely monitor quarterly earnings reports and future guidance provided by companies before making investment decisions.

• The US presidential election, which scheduled in November 2024, can introduce market uncertainty. Investors may react based on perceptions of how certain policies could affect industries, taxes, trade, and overall economic growth.

• Geopolitical risks: These risks create uncertainty and can influence investor confidence, leading to market fluctuations. For instance, trade tensions between major economies can disrupt supply chains, impacting corporate profitability and investor sentiment.

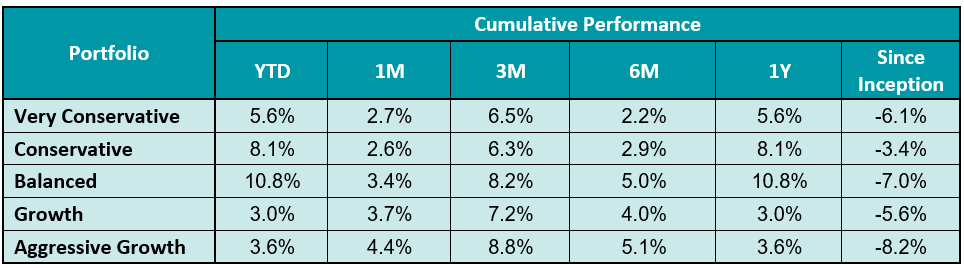

Table 1: KDI Invest Portfolio Performance As at 31 December 2023

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from –8.2% to -3.4%. Notably in 2023, all portfolios recorded returns within a range of 3.0% to 10.8%.

The equity market is expected to receive support from positive earnings growth in technology companies, driven by the demand for A.I., despite current high valuations resulting from a robust rally in 2023. The CBOE Volatility Index (VIX), which closed at a low level below 14 at the end of 2023, indicating investors’ optimism and confidence in the current market stability.

In fixed income, the yield curve inversion—where the US treasury two-year yield surpasses the 10-year yield—has signaled an impending recession since its onset in July 2022. This inversion fuels speculation that the central bank will cut rates in 2024 to bolster economic growth. Expectations of Fed interest rate cuts could potentially moderately increase bond prices. The Fed funds futures market indicates a projected 1.5 percentage point cut in the year ahead, possibly bringing the benchmark funds rate down to a target range of 3.75%-4.0%. With declining interest rates and looming recession risks, fixed income becomes more appealing.

The commodities outlook appears mixed due to the anticipated global economic slowdown. Oil prices will likely be influenced by OPEC+’s supply tightening, reduced oil demand from geopolitical tensions, or a slowdown in global economic growth.

The US dollar is anticipated to weaken if the Federal Reserve pauses and reverses its monetary policy. Gold is likely to be considered a preferred safe-haven asset during volatile times and amid a weakening US dollar.

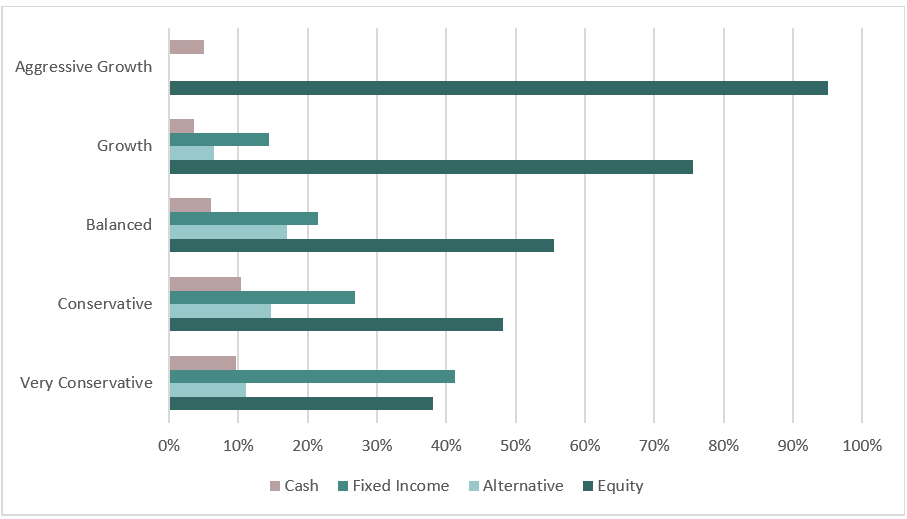

The KDI portfolios maintain diversification by investing across various asset classes: equities, with exposure ranging from 38% to 95%; fixed income, with exposure varying from 0% to 41%; alternative investments, with exposure ranging from 0% to 21%; and cash holdings, with exposure between 3% and 11%. These portfolios will be adjusted based on KDI A.I.’s analysis of market conditions while maintaining a consistent overall portfolio strategy.

Chart 2: Asset Class Exposure As at 31 December 2023

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customization by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.