Jargon Buster: Loan-To-Value (LTV) Ratio

Buying a home is one of the biggest milestones of a person’s life. It is the moment when you know that you are truly ready to give yourself and your family the life you have always dreamed of. The ability to even consider taking on a mortgage is a testament to your hard work and determination.

There’s a lot of jargon and a lot to figure out – but it does not have to be confusing, as we have demonstrated in our article about debt-to-income (DTI) ratios. As part of KDI’s initiative to make jargon more decipherable for every consumer, today we look at Loan-to-Value (LTV) ratio — also known as the Margin of Finance — is a lending risk assessment ratio used by financial institutions and other lenders before approving a mortgage.

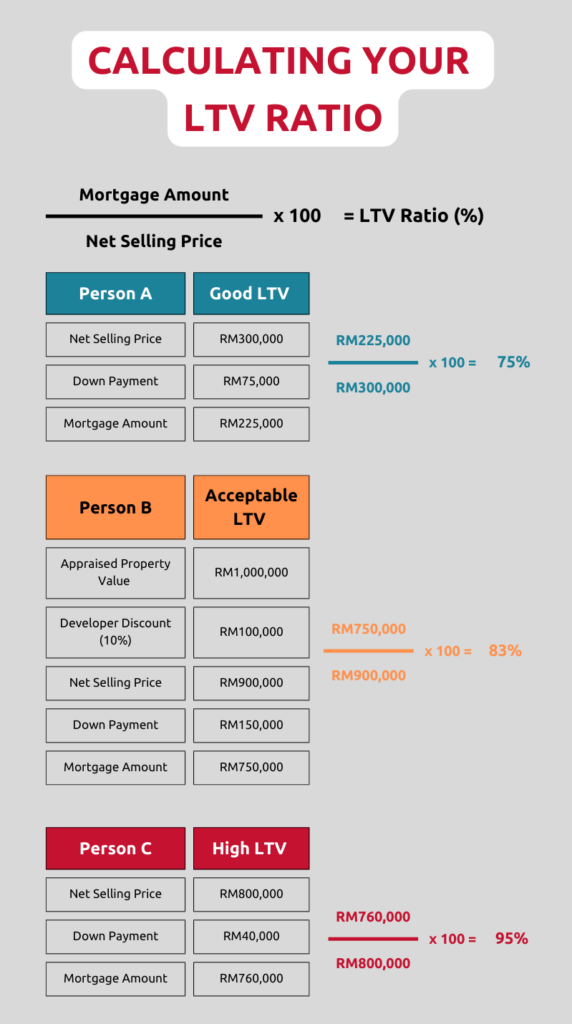

Your LTV ratio is calculated by dividing your home loan (mortgage) amount with the net selling price of your home. So if you are buying a RM600,000 condominium unit with an RM50,000 down payment and financing the remainder RM550,000 with a home loan, your LTV ratio would be RM550,000 / RM600,000 = 0.91.

Why LTV Ratios?

Financial institutions use the LTV ratio as an assessment of lending risk when considering your mortgage application. Assessments with a high LTV ratio are usually considered as higher risk. If the mortgage application is accepted, the loan will cost you more as it will have a higher interest rate.

If the LTV ratio is high enough to cause concern, you may even have to purchase mortgage insurance to offset the risk the lender is taking by underwriting the loan for you. This may make you want to lower your LTV ratio as much as possible to be more appealing to lenders as they will not see you as a risky investment.

In Malaysia, the normal expected LTV ratio for a housing loan is 90% to 95%; however, there are government schemes to facilitate buying homes, such as the Skim Rumah Pertamaku which allows up to 100% LTV ratio to qualified first-time home buyers.

Bank Negara Malaysia (BNM) issued a policy regulating the LTV ratio for housing loans, so the maximum LTV ratio is capped at 70% for borrowers purchasing their third home (it does not apply to first and second homes).

According to PropertyGuru, banks in Malaysia are required to calculate the LTV ratio based on the property’s net price instead of the price stated in the Sale and Purchase Agreement (SPA). This is to counter the significant discounts buyers can get as rebates and incentives by developers which would allow the buyers to make a lower down payment but leverage a higher margin of finance.

How to Calculate Your LTV

If you have an idea of the property you want to buy, the average price of housing in that area, or can estimate the mortgage amount you will be approved for, you can calculate your LTV ratio by yourself. It may not be exactly what your bank will arrive at – but having a number to work with will allow you to prepare and reorganise your finances to help make your LTV ratio more attractive to the financial institutions you approach.

The main factors that impact LTV ratios are: the amount of the down payment; the (net) sales price; and the appraised value of a property. The lowest LTV ratio is achieved with a higher down payment and a lower sales price, though some banks may have a set down payment percentage which you may or may not need to negotiate.

Consider the following examples:

Why Banks May Limit LTV Ratios

Apart from BNM regulations, banks also limit the LTV ratio based on an institution’s internal credit policies. Inquire with multiple banks about their policies, and compare and contrast to choose the one that is best suited to your needs.

If you have more than one existing housing loan, this can cause banks to go with a Combined LTV ratio which looks at your primary mortgage and any home equity loans.

If you are buying the property for investment reasons instead of for personal use, you may receive closer scrutiny. Speculative property purchasing due to affordable rates in the past has led to a decline in affordability for many people in many residential areas. Thus, the bank will need to consider whether making the loan is a sound investment, or an excessive investment.

Meanwhile, if you are a Malaysian who does not primarily live in Malaysia, the bank may need more assurances for why you are purchasing this property. It is just a cautionary measure.

Foreign nationals hoping to purchase homes in Malaysia may face more restrictions from the banks as they have less ties – and thus, less incentives – to stay in the country and complete their payments. Many factors – the state of your financial health; your reasons for purchasing the home; your qualification under a government scheme; or having a very good long-term work contract – can all make a difference on whether your application is well-received.

Save Up For Your Dream Home with KDI Invest

If you already have savings towards a home, that is great – but if you do not, the best time to start is right now. By putting your savings in KDI Invest, you will eventually be able to present your chosen financial institution with proof of capability in the form of a healthy down payment amount towards your first home.

You do not have to compromise on your dreams when you have a robo-advisor like KDI Invest. KDI Invest uses algorithmic investing to choose U.S.-based exchange-traded funds (ETFs) with reliable market behaviour. This A.I.-driven tool is capable of rebalancing your portfolio according to the time horizon you designate.

KDI Invest can help you make sound investment choices to give you a healthy down payment when the time is right, without the risk of time pressure-led emotional choices. It also always seeks to maintain a diverse basket of investments, which is at all times based on your individual risk appetite. All this means that you can now dream with surety about your future home. Explore KDI Invest at https://digitalinvesting.com.my/ today!