March 2023 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 14th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

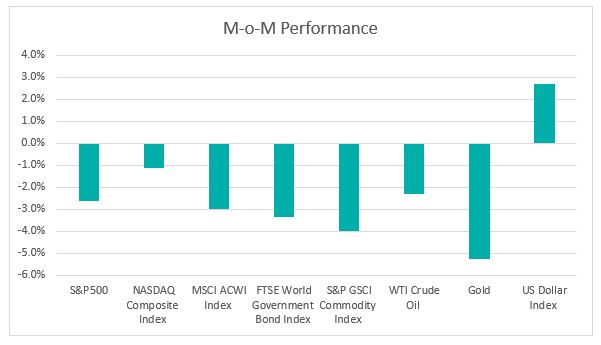

Chart 1: Index Performance in February 2023

Market

In February, global equity markets experienced a decline after a strong performance at the beginning of the year. This was due to concerns that the US Federal Reserve would maintain its hawkish policy for a longer period, following signs of a strong US economy and elevated inflation. The S&P 500 and Nasdaq Composite saw declines of 2.6% and 1.1%, respectively.

US Treasury yields moved higher, with the benchmark 10-year yield hitting 3.92%, and the two-year yield, which is sensitive to Federal Reserve policy, rising to 4.8158%, the highest since November 2022. Despite this, the gap between yields on two-year and 10-year notes remained inverted at minus 89.6 bps, indicating that bond investors are still expecting the risk of recession.

Additionally, concerns about global growth and subdued demand resulted in a 4.0% decline in the S&P GSCI Commodity Index. WTI crude oil continued to slide, posting a monthly decline of 2.3%, pressured by the concerns of further Fed interest rate hikes weighing on demand. Gold prices declined further after hitting a nine-month high on January 26, 2023, driven by the stronger dollar and higher bond yields.

The US dollar strengthened against other major currencies, with the US dollar index up 2.7% after higher-than-expected inflation data revived expectations that the Federal Reserve will maintain its hawkish stance for a longer period than expected.

Outlook

Regarding the economy, the personal consumption expenditures (PCE) price index, which is the inflation measure preferred by the Fed, rose by 0.6% in January, a significant increase from the 0.2% rise observed in December. The Bureau of Labor Statistics released data indicating that the producer price index (PPI) also rose by 0.7% in January, the largest increase since June, mainly due to higher energy costs. The core PPI, which excludes food and energy prices, increased by 0.5%, surpassing expectations for a 0.3% increase.

Due to the higher-than-anticipated inflation data in January, the Federal Reserve is generally expected to continue to increase interest rates. The US central bank has raised its policy rate by 450 basis points since March of last year, increasing it from nearly zero to a range of 4.5%-4.75%. The Fed is expected to deliver two additional rate hikes of 25 basis points in March and May.

Additional economic data shows that the US economy added 517,000 jobs in January, while the unemployment rate remained low at 3.4%. These positive indicators suggest that the economy is resilient and the labour market is healthy, decreasing the likelihood of a recession in the near future. In a recent survey conducted by Bank of America Global Research, only 24% of global fund managers expect a recession, a substantial decrease from 77% who predicted a recession in November.

China’s reopening has generated positive sentiment and is reflected in recent economic data, including stronger Purchasing Manager Index (PMI) and credit growth. In February, China’s PMI index was at 52.6, an increase of 2.5 percentage points from the previous month and recovered from the recent low of 47.0 recorded in December 2022. New loans increased 17.3% y-o-y to RMB 4.93 trillion in January. Bank loans in China are expected to continue to grow throughout 2023, following a record-setting January, as the country emerges from the pandemic. The Chinese government has set a target of 5% GDP growth for 2023. The reopening of China’s economy is likely to have a positive impact on the global economy.

Business activity in the eurozone has continued to improve, as evidenced by S&P Global’s flash composite purchasing managers’ index climbing to a nine-month high of 52.3 in February, bolstered by unexpectedly strong growth in the services sector. The inflation pressures in the 20-nation eurozone have begun to ease, with inflation falling to 8.5% in January from a peak of 10.6% in October.

The persistent inflation, and strong job data in the US, combined with rebounds in economic activity in Europe and China, suggest that central banks are likely to maintain a hawkish stance in their monetary policy.

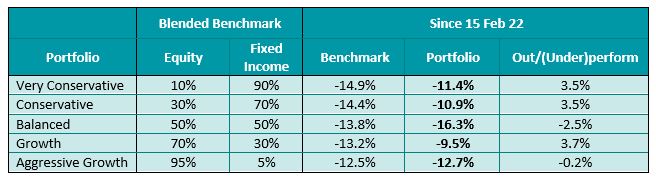

KDI Invest Portfolio Performance As at 28 February 2023

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table provides information on the performance of selected KDI portfolios since their launch on February 15, 2022. All portfolios have experienced negative returns, ranging from -16.3% to -9.5%, which could be attributed to the volatile market conditions. The portfolios have also shown varied levels of outperformance or underperformance against the benchmark, ranging from -2.5% to 3.7%.

As market drivers such as inflation, economic data, Fed monetary policy, and geopolitical uncertainty will continue to have an impact on the markets in the near term, the portfolios’ equity exposure, fixed income exposure, and cash holdings will be adjusted based on KDI A.I.’s analysis of market conditions while keeping the overall portfolio strategy consistent.

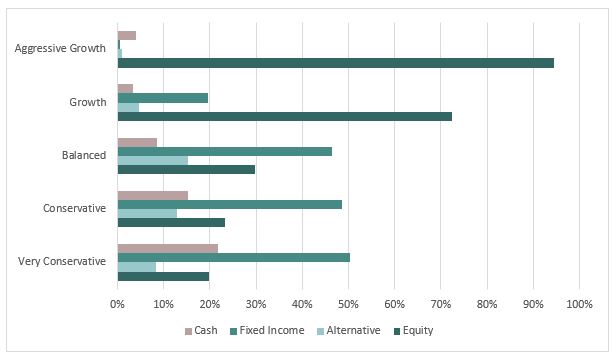

Chart 2: Asset Class Exposure As at 28 February 2023

Please note that the above performance and asset class exposure are based on five proxy portfolios. Actual KDI Invest portfolio performance may vary from the above due to the customization by the KDI robo-advisor A.I. based on investors’ risk profiling, as well as the timing of market entry.