May 2024 Market Insights

Welcome to the May edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

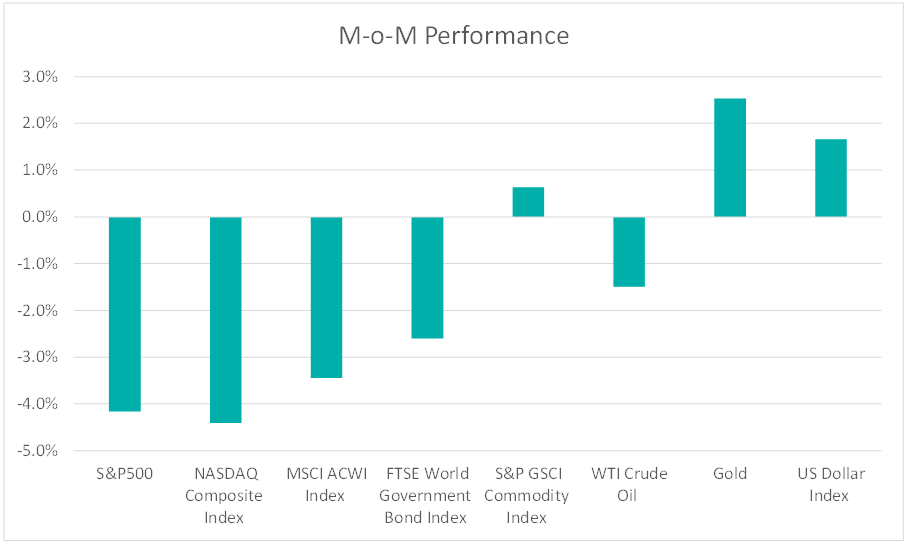

Chart 1: Index Performance in April 2024

Market

Equity markets faced a challenging month, with the S&P declining by 4.2%, the Nasdaq by 4.4%, and the MSCI ACWI indices by 3.4%. This downturn follows a five-month rally that began in November, as investors recalibrate their expectations for interest rate cuts by the US Federal Reserve due to sustained inflationary pressures. The start of the first-quarter earnings season saw megacap stocks and chipmakers experiencing declines. Disappointing performances from Meta and Netflix further weighed down index performance.

US Treasury yields surged to fresh year-to-date peaks, with the two-year Treasury yield surpassing 5%. Meanwhile, the yield on the 10-year Treasury yield surged by 80 basis points since the beginning of the year, reaching 4.6798%, marking its highest level in five months. With US inflation persistently overshooting the Federal Reserve’s 2% long-term target, bond investors are adjusting their expectations for monetary policy, anticipating a delay in the onset of Fed rate cuts. According to the latest data from the CME FedWatch Tool, futures markets indicate that investors are now anticipating the Fed to implement rate cuts ranging between 25 to 50 basis points throughout the year.

Gold prices rose above US$2,400 per ounce to an all-time high on April 12; however, they slipped from the peak as concerns eased and focus shifted to US economic data for clues on interest rates. Investors awaited key inflation readings for rate direction, and prices dropped slightly. Gold closed at US$2,286 per ounce at the end of the month. Meanwhile, oil prices saw volatility driven by geopolitical tensions, particularly in the Middle East. Oil prices dipped as fears of wider conflicts eased when Iran’s attack on Israel proved to be less damaging than anticipated, easing concerns of a quickly intensifying conflict that could displace crude barrels.

The US Dollar Index, which tracks United States dollar relative to a basket of foreign currencies, strengthened by 1.7% during the month, reaching a 6-month high on the prospect of higher-for-longer interest rates.

Outlook

The US economy has displayed resilience through strong consumer spending and a robust labour market, maintaining a 3.8% unemployment rate despite higher-than-anticipated inflation. The core Consumer Price Index (CPI), excluding food and energy, increased by 0.4% monthly and 3.8% annually. Although inflation has eased from its mid-2022 peak of 9%, it remains elevated at a 3.5% annual rate as of March 2024. Since July 2023, the Federal Reserve has kept its benchmark interest rate steady between 5.25% and 5.5%, following 11 consecutive rate hikes since March 2022. The Federal Reserve has expressed concerns about the lack of further progress in inflation data this year toward its 2% target, indicating that the current policy level is likely to remain until inflation approaches the target. The Fed is expected to maintain its policy rate unchanged until November, as suggested by the latest CME Fed WatchTool.

Despite the deepening crisis in China’s property sector, the country’s economy showed signs of improvement at the beginning of 2024. According to data released by the National Bureau of Statistics, China’s gross domestic product (GDP) expanded by 5.3% in the first quarter compared to the previous year, surpassing analysts’ expectations of a 4.6% increase. This growth rate was also slightly faster than the 5.2% expansion seen in the previous quarter. Foreign investors are increasingly optimistic about Chinese shares due to low valuations and stronger growth prospects, leading to a third consecutive month of inflows in April. As a result, the CSI 300 Index, a benchmark tracking the largest market cap stocks listed in Shenzhen and Shanghai, gained momentum over the same period.

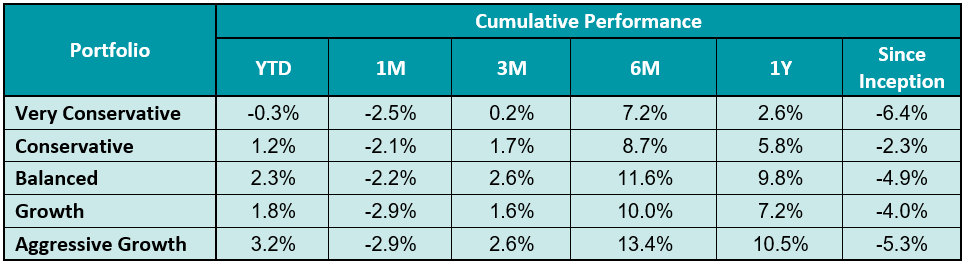

Table 1: KDI Invest Portfolio Performance as at 30 April 2024

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. The portfolio returns (in USD) range from -6.4% to -2.3%. Year-to date, all portfolios recorded returns within a range of -0.3% to 3.2%.

In light of the challenging market conditions in April, both stock and bond markets incurred losses as expectations of higher interest rates rose. The MSCI ACWI Index declined by 3.4% and the FTSE World Government Bond Index dropped by 2.6%, reflecting the global market sentiment. The investment environment is fraught with various risks that could impact significant market performance and volatility. Some of the key risks are geopolitical tensions in the Middle East, the upcoming US presidential election, monetary policy actions of central banks, and ongoing trade disputes between the US and China.

KDI’s portfolios are well diversified to withstand market fluctuations, and will remain vigilant in monitoring changes, adjusting asset allocation when necessary. This approach enables portfolios to capitalize on opportunities and potential benefits that may arise from these risks.

Chart 2: Asset Class Exposure as at 30 April 2024

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.

Citation: