November 2022 Market Insights

Brought to you by the Kenanga Digital Investing (KDI) team, here is our 10th Market Insights column. Our Head of Digital Investing, Cheong Yew Huan will discuss the latest in financial news and present his thoughts on making the most of today’s market.

Market Recap

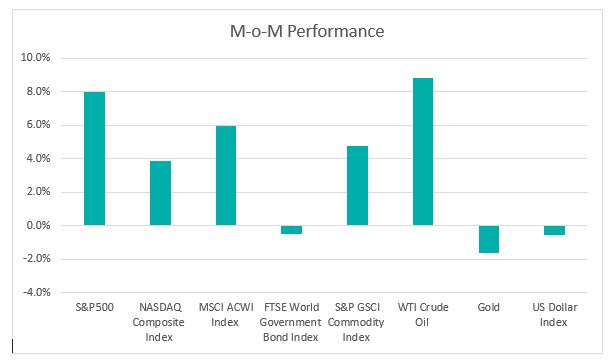

Chart 1: Index Performance in October 2022

Market

After months of declines, the S&P500 and Nasdaq gained 8.0% and 3.9%% respectively in October on the speculation of the Federal Reserve might start a slower pace of raising interest rates from December onwards. The rebound was led by value sectors such as energy, financials, and healthcare while the performance of Nasdaq was dragged by the disappointing earnings reports from big tech companies. Year-to-date, the S&P500 and Nasdaq Composite Indexes were down 18.8% and 29.8% respectively.

It has been a challenging year for bond market investors. With bond prices falling and yield increasing, the FTSE World Government Bond Index has declined 21.7% this year. During the month, the two-year Treasury yield increased from 4.27% to 4.49% while the ten-year Treasury yield rose from 3.83% to 4.05%. With inflation still at four-decade high and central banks signalling an aggressive pace of rate hikes, the bond market volatility will stay elevated in the near term.

The S&P GSCI Index posted monthly positive returns of 4.8% in October with energy being the best-performer during the month. The WTI Crude Oil price gained 8.9% during the month, driven by the OPEC+ oil production cut and the European Union’s embargo of Russian oil.

The US Dollar Index gained 16.6% this year on Fed hawkishness and safe-haven appeal during the Russia-Ukraine conflict. The upside momentum faded in October and the US Dollar Index maintained at 110 level. The inflation expectation and Fed’s decision on benchmark rates will drive the US Dollar movement in the future.

Outlook

Global manufacturing production fell again in October and marks a third consecutive monthly contraction, signalling the global economic growth momentum has slowed. The J.P. Morgan Global Manufacturing PMI, compiled by S&P Global, a snapshot of the health of manufacturing around the world, fell to a 28-month low of 49.4 in October from 49.8 in September. Of the 31 economies for which S&P Global PMI data, 21 economies reported falling production. China, the euro area, and Japan were among the key manufacturing economies to see output contract during the month, driven by weaker intakes of new business, deteriorating international trade flows, and lower business confidence.

IMF warned that the global economy is at increasing risk of recession and a third of the global economy may experience at least two consecutive quarters of contraction this or next year. The IMF expects global economic growth will slow from 3.2% in 2022 to 2.7% in 2023. This is the lowest growth since 2001 besides the global financial crisis and the acute phase of the COVID-19 pandemic.

One of the biggest headwinds is the slowdown in China due to the impact of the zero-COVID lockdown and the deepening property crisis. IMF projected Chinese growth of 3.2% in 2022, its second lowest growth since 1977. China’s factory activity weakened in October, weighed by softening global demand and strict Covid-19 restrictions, which hit production. The scattered Covid outbreaks in China have prompted tighter controls. One of the companies most notably hit is Foxconn, one of the main suppliers to technology giants worldwide, where the Chinese government ordered a seven-day lockdown of the area around Foxconn Technology Group’s main plant in Zhengzhou.

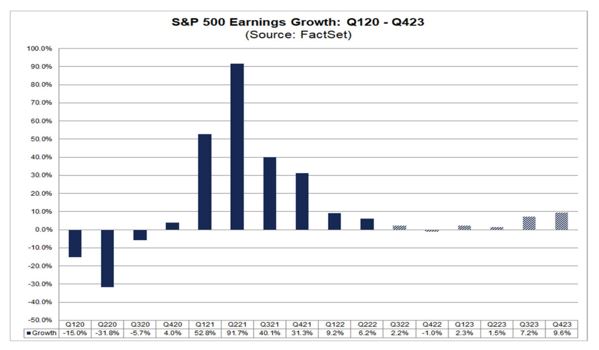

The release of US corporate third-quarter earnings is expected to drive market movement in the near term. Overall, 85% of the companies in the S&P 500 have reported their third-quarter earnings to date. The disappointing quarterly results from Google, as well as Microsoft Corp and semiconductor giant Texas Instruments Inc, have put a drag on the market rally. Alphabet missed expectations and reported a decline in YouTube ad revenue, signalling trouble ahead for tech companies reporting earnings. Microsoft’s earnings were affected by slower-than-expected growth in its cloud computing business, Microsoft Azure .

The expectations on Q4 2022 earnings growth have been falling over the past few months. Looking ahead, analysts now expect a decline in earnings of -1.0% for Q4 2022. For the first and second quarters of 2023, analysts are projecting earnings growth of 2.3% and 1.5%. For CY 2023, analysts predict earnings growth of 5.9%. Seventy-three companies in the S&P500 index have issued EPS guidance for Q4 2022. Of these 73 companies, 50 have issued negative EPS guidance and 23 have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance for Q4 2022 is 68% (50 out of 73), which is above the 5-year average of 60% and slightly above the 10-year average of 67%.

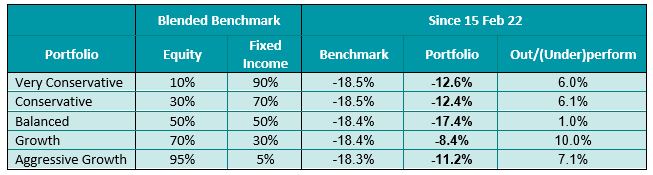

KDI Invest Portfolio Performance As at 31 October 2022

Remarks:

Benchmark: Equity: MSCI ACWI Index + Fixed Income: FTSE World Government Bond Index

Past performance is not indicative of future results.

The above table shows the performance of selected KDI portfolios since their launch on 15 February 2022. The portfolio returns are ranging from -8.4% to -17.4%, outperforming the benchmark by 1.0% to 10.0%.

The monetary policy tightening is expected to stay in place for the coming quarters as central bankers predominantly focus on inflation to the detriment of growth and employment. Given the current challenging environments due to the stronger dollar and persistently high inflation, the corporate earnings estimate for next year could potentially be revised lower.

The defensive strategies remain intact by keeping the portfolio’s risk at a low level amid current market volatility. All portfolios are heavily weighted in fixed income with allocation towards short-duration bonds and high-quality government bonds. The main holdings include iShares Short Treasury Bond ETF (SHV), SPDR Bloomberg Barclays International Treasury Bond ETF (BWX), and iShares 7-10 Year Treasury Bond ETF (IEF). The equity exposure is maintained at a minimal given the downside risk of equity market persists due to ongoing central bank tightening monetary policy and increased recession risk.