November 2023 Market Insights

Welcome to the November edition of the Market Insights column brought to you by the Kenanga Digital Investing (KDI) team. In this edition, Our Head of Digital Investing, Cheong Yew Huan, will discuss the latest financial news and share his insights on how to make the most of today’s market.

Market Recap

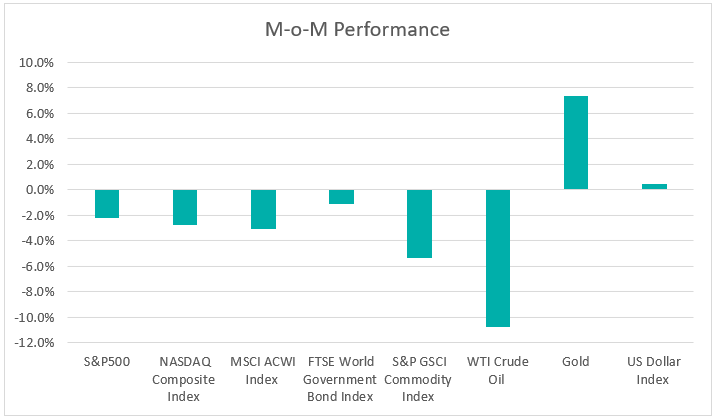

Chart 1: Index Performance in October 2023

Market

Equity markets experienced a third consecutive month of decline as of October, with the MSCI ACWI Index dropping 3.1%. The S&P 500 and Nasdaq fell by 2.2% and 2.8%, respectively. This decline in equities was driven by expectations that the Federal Reserve would maintain a more prolonged period of restrictive monetary policy than initially anticipated. The Israel-Hamas war, which commenced in early October, added further turbulence to global financial markets.

In the fixed income market, the 10-year US Treasury yield briefly surpassed 5% for the first time since 2007 before retracing, closing the month at 4.9307%. This decline in yield was driven by a shift in investors’ expectations, as they began to anticipate that persistently high interest rates could slow global economic growth

Gold reached a six-month high, exceeding USD2,000 per ounce when Israel initiated its ground assault on Gaza. In contrast, oil prices initially reached the USD90 per barrel mark but later declined due to weak global economic data overshadowed over concerns about the potential for the Israel-Hamas conflict to escalate into a larger regional conflict, which could further tighten the global oil supply. Throughout the month, WTI Crude oil experienced a decrease of more than 10%, dragging on the performance of the S&P GSCI Commodity Index, which dropped by 5.4% during the period.

The US dollar held up well against most of its major peers as investors appeared to be shrugging off fears of growing geopolitical tensions in the Middle East. The strengthening of the US dollar was also supported by its underlying economic trends and the surge in US Treasury yields.

Outlook

The economic data released in October suggests that the US economy remains resilient. While the unemployment rate in October stood at 3.9%, slightly higher than the 3.8% from the previous month, the job market still appears healthy, though it is displaying signs of losing momentum. Consumers demonstrated unexpected strength in September, with retail sales increasing by 0.7%, according to the Commerce Department. Additionally, manufacturing output rose by 0.4% in September, exceeding expectations, despite month-long strike affecting automobile production.

During the latest Federal Open Market Committee (FOMC) meeting, the Federal Reserve maintained its benchmark policy rate within the current range of 5.25% to 5.5%. This decision marked the second consecutive meeting where the FOMC chose to keep rates steady after a series of 11 rate hikes. The positive job data, strong retail sales, and factory output have given the Federal Reserve the confidence to maintain interest rates for a more extended period.

Sluggish consumer spending and export demand continue to pose concerns for China’s economy. Weakness in the real estate sector, coupled with US restrictions on AI chip exports, has dampened sentiment in the Chinese market. The country’s stock market index has also dropped to its lowest level since 2019, before the COVID pandemic, due to declining home sales and debt troubles. In October, the Manufacturing Purchasing Managers’ Index unexpectedly contracted to 49.5, a decrease of 0.7 points from the previous month, highlighting the challenging outlook amidst a prolonged property crisis and soft global demand.

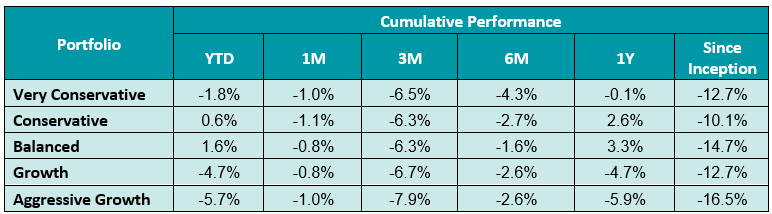

Table 1: KDI Invest Portfolio Performance As at 31 October 2023

The provided table offers information on the cumulative performance of selected KDI portfolios since their launch on February 15, 2022. Year-to-date, all portfolios have recorded returns within a range of -5.7% to 1.6%.

In summary, October posed challenges for investors as both stocks and bonds experienced declines. Investors became more cautious due to the Israel-Hamas conflict and uncertainty surrounding US interest rates. The key factor moving forward is the sustainability of economic strength, which will influence both interest rates and market direction.

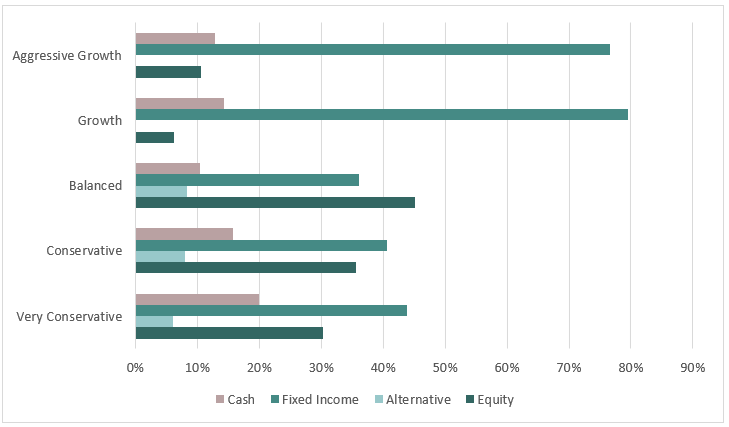

With the rebalancing triggered in October 2023, the current allocation to equity is up to 55%. Fixed income constitutes an allocation of up to 79%. The portfolio strategy remains intact with investing in multi-asset and diversified globally. All portfolios are customized based on investors’ risk tolerance and able to traverse through market volatility.

Chart 2: Asset Class Exposure As at 31 October 2023

Please note that the performance and asset class exposure mentioned above are derived from five proxy portfolios. The actual performance and exposure of KDI Invest portfolio may differ due to the customisation by our A.I. based robo-advisor, which tailors investment to individual risk profiles, as well as the timing of market entry.

Citation:

https://www.federalreserve.gov/releases/g17/current/default.htm