The Differences Between Trading and Investing

In financial how-tos and advertisements, trading and investing are often used interchangeably. But do you know there are several key differences between trading and investing?

Yes, both investors and traders aim to profit via market participation, but they differ in their strategies and time horizons. Investors look for value investments, so they stick with their investments for a very long time – often a multi-year period.

Generally, traders take advantage of both rising and falling markets to enter and exit positions over a shorter time frame – typically within the same day (intraday trading) – taking smaller but more frequent profits.

Comparing Trading and Investing

4 Common Trading Strategies

Investopedia defines active trading as buying and selling securities for quick profit based on short-term movements in price. Traders attempt to ‘beat the market’ by identifying and timing profitable trades, often for short holding periods. Active trading strategies include day trading, swing trading, scalping, and position.

Per its name, day trading entails opening and closing positions within the same trading day (intraday). Day traders tend to rack up high transaction fees due to completing multiple orders in a single day, but their gains are typically small.

Meanwhile, swing trading relies heavily on technical analysis to identify when to enter and exit a position. When a trend ends – say, the general weakness in tourism or oil markets due to coronavirus-linked lockdowns – there is typically some price volatility with sudden swings up or down. This is where swing traders thrive. Since swing traders have more concentrated positions – in a certain sector or commodity – they see higher potential for larger returns or larger losses per trade.

Scalp traders aim to profit from tiny price changes and only hold positions open for seconds or minutes at most. Scalping often requires larger amounts of upfront capital to make larger profits due to the small amounts of profit per trade.

Position traders tend to use weekly and monthly price charts to analyse and evaluate the markets, using a combination of technical indicators and fundamental analysis to identify potential entry and exit levels. Typically, they ride the wave of a trend that has solidified (establishing a position), and when the trend breaks, they usually exit the position.

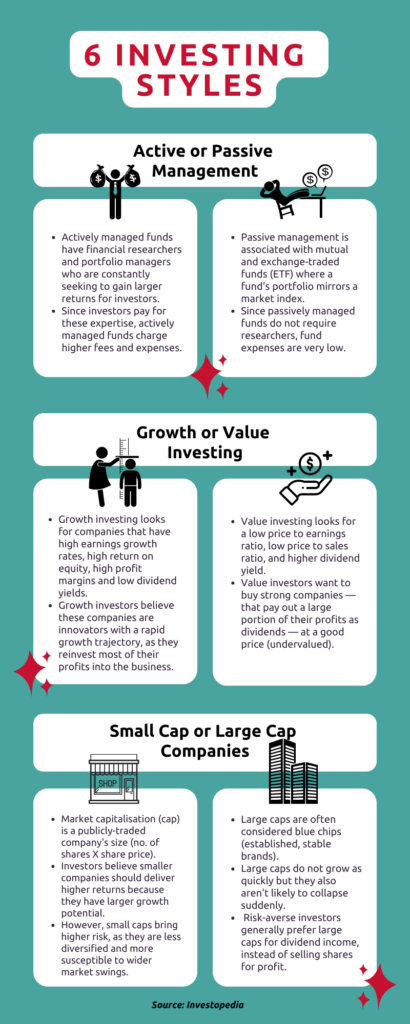

6 Investing Styles

Separate Your Trading & Investing Pools

With so many different strategies and styles available, you must first understand your purpose or objective of entering the market before allocating money to trading and/or investing. If you are attempting both, do not mix the two money pools.

Want to try investing but not sure what your investing style is? Try out KDI Invest, a robo-advisor which leverages artificial intelligence to find an investment style that best fits your risk profile and time horizon.

KDI Invests builds a diversified portfolio across dozens of high-quality U.S.-based ETFs, a perfect blend of active and passive investing styles. KDI’s active management aspect is a result of its dynamic portfolio rebalancing mechanism, whereas it takes a passive management approach by investing in ETFs that track multi-asset classes or indices.

Another passive management benefit? With zero human intervention, KDI Invest’s super-low fees range from 0.3% to 0.7% annually. Download the KDI app today or learn more at www.digitalinvesting.com.my/invest.