What is the Efficient Frontier?!

The Efficient Frontier was first formulated by award-winning American economist Harry Markowitz in 1952, and has had a profound influence on modern portfolio theory. Now that investing has become more accessible and seen as a valid source of a secondary income, the theory has been revived as a tool to help investors create their optimal portfolio.

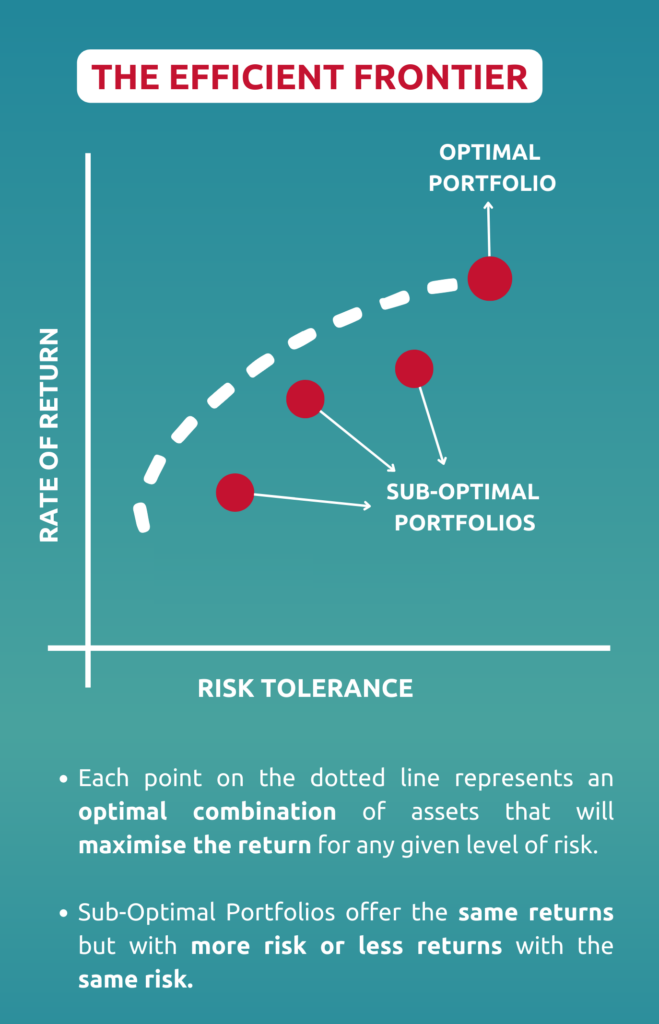

The theory describes a set of portfolios that offer the highest expected returns for specific risk preferences. It can also be a portfolio that offers the lowest risk for the returns that you want. Portfolios that do not meet this frontier are termed as “suboptimal” because they have too much risk compared to the potential returns.

In many ways it is a mathematical answer to the age-old investment question: “How do I get the best return for the least amount of risk?” Following this theory allows investors to feel more secure about their investments, as there are mathematical principles behind the choices they make, and reduces the chances of being overly influenced by emotion into making investment choices that are either too risky or too safe.

This “fear of human emotion causing suboptimal investments” is also what has led to the creation of robo-advisors in modern investing. Robo-advisors have made investing even more accessible, and have taken a great deal of needless agitation out of investing because they use algorithms and Artificial Intelligence (AI), and can be programmed to take risk preferences into account.

Understanding what the Efficient Frontier theory is about can help you to understand these modern investment tools better.

What is the Efficient Frontier?

Finding the right risk-to-return balance for you puts your portfolio on the efficient frontier. This theory is also the key reason why investment experts recommend diversification as a necessity when creating a successful portfolio.

The theory shows that returns are dependent on your investment combinations; if the balance within your portfolio offers the highest returns for a lower or equal amount of risk, then it is the most efficient portfolio for your needs. The important thing is to know what your degree of risk tolerance is first; if you have a higher tolerance, then your ideal balance will be very different from someone who is more risk averse. This does not mean that either of you has it wrong – it just means that the efficient frontier for you is different than the one for the other person.

Ironically, although it is a fact that diverse profiles do better, there comes a point where too much diversification leads to diminishing returns. This theory helps highlight the fallacy that riskier investments always lead to better returns, as the theory shows that there is an ideal balance that lies in knowing your exact risk tolerance level.

Your best bet is to have a mix of risky and safe investments that balance each other out, and that add up to a level of risk that does not keep you up at night worrying about your financial future.

Should It Guide Your Portfolio Management?

As with anything that relies on our best judgement, the answer is: “Yes and No”. Investing is a risky business; you can do your best to reduce risk, but there is no such thing as a “sure thing”.

Seeking the ideal frontier for your investments is smart as it helps you to organise a portfolio that affords a sense of stability, which can help you to stay the course during any economically uncertain times.

On the flip side, the theory relies on a lot of assumptions, including that the risk-return characteristics of assets will be similar in the future as they were in the past. It does not account for the influence of outside events including changes to market environments; irrational behaviour from external investor(s); unexpected economic upheavals; or political strife.

Additionally, there are many individual factors that come into play when plotting the efficient frontier. Your risk preference is a major factor – but the number of assets in your portfolio and even the type of assets (stocks, bonds, real estate, foreign investment, etc) all play a part in finding the balance. This means that you cannot look to another person’s successful portfolio, copy it entirely, and hope for the same results.

Create Your Optimum Portfolio With KDI Invest

There are many advantages to choosing KDI Invest – but one of the best is that it uses a robo-advisor which means the need to learn about the efficient frontier and to plot points on a graph can be taken out of your hands.

KDI Invest only chooses exchange-traded funds (ETFs) with reliable market behaviour – so you can invest with certainty knowing that it is seeking the optimum returns suited to your risk profile, thus ensuring that your portfolio always falls within the efficient frontier.

Plus, this investment tool uses the most up-to-date market data and A.I. to respond in near real time, so that it can adjust your investments to maximise your returns while keeping your risk preferences as a constant guide. This kind of fluid portfolio management helps to significantly reduce the risk posed by the assumptions within the efficient frontier theory.

With as little as RM250 for an initial deposit to get started, KDI Invest is certainly an efficient way to start your journey along the Efficient Frontier.