What to do with your bonus?

The time of the year is here again, and businesses are doing better as they return to 100% production capacity. Your company closed last year with good sales and is back in the black. Yes, it’s bonus cheque time!

It’s been a tiring slog the last two years. Yes, you’ve been lucky to stay employed/get a new job in the middle of a global pandemic, but this year’s bonus will be your first in a long time. Why not treat yourself?

There’s been a lot of talk of “revenge spending/shopping/travel”, meaning people coming into a windfall (such as a bonus) and emerging from Covid-19 isolation are spending aggressively on items they missed out on during the past few years.

Of course you should treat yourself! You’re human, after all. You definitely need a reward for making it through a once-a-century event, and if you – like many others – have been pulling double and triple duty during the pandemic, certainly a holiday is not out of the question.

However, “treating yourself” also means taking care of yourself. So, while you’re heading for a relaxing spa or massage for your physical health, make sure to set aside part of your bonus for your financial health. Take care of your finances as well, especially if you want to be better prepared for the next big event.

Make a Wish (List)

There are many ways to treat yourself while setting aside sums for the future. Some divide their bonuses by percentages, others choose to sort out urgent needs (such as that loan restructuring you had to go through), and others still prefer to optimise their taxable income.

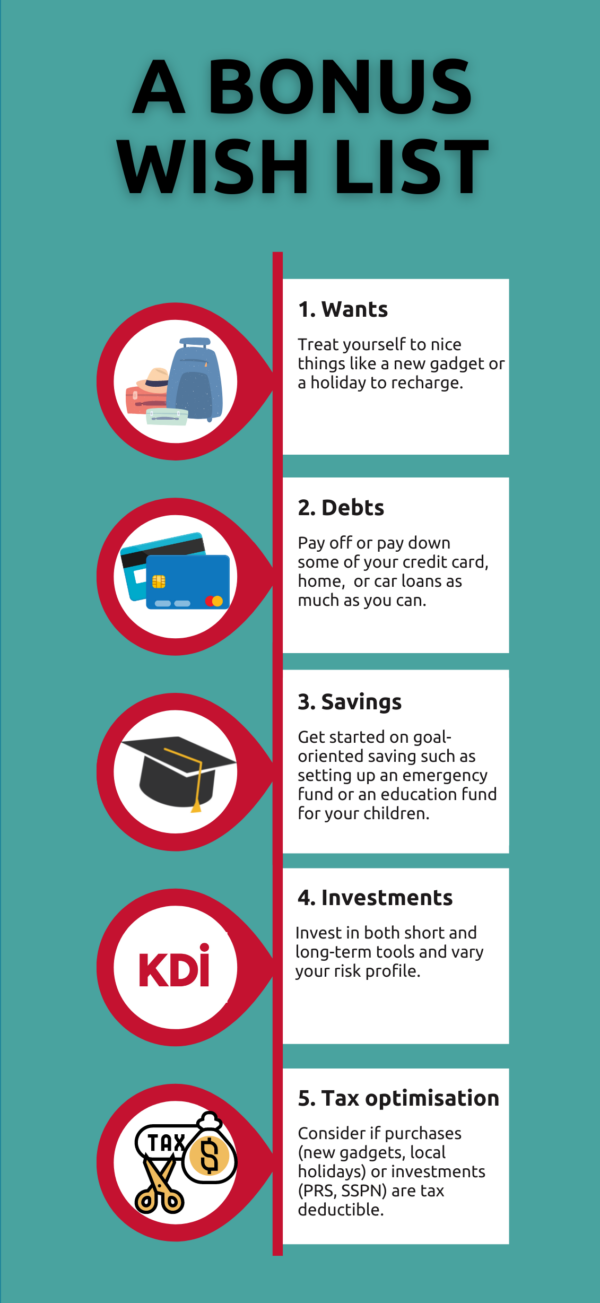

Whatever your personal preference, sorting out how to best spend your bonus starts with being your own Santa Claus: making a list. Start by listing all your spending/investment options, from needs and wants, to paying down debts, setting aside savings, and investing long-term.

Once you’ve made your list (and checked it twice), figure out how much money each item requires, and arrange them by priority. These may differ based on your long-term goals (retire by 60 or set up your kid’s education fund) to identify which options make the most sense to maximise your bonus cheque.

Here are a few ideas for your list:

After sorting out your priorities, go in-depth into your wish list and consider whether you will be able to follow through on certain commitments on your typical cash flow. For instance, for big-ticket items such as down payments on a house and car can you pay the ensuing monthly loan amounts comfortably with your monthly wages?

If the answer is “no” or “maybe”, perhaps you should press pause on such decisions and continue to grow your savings pot by temporarily parking parts of your bonus into low risk saving options such as KDI Save (3% per annum interest, with returns tabulated daily and no lock-in period) or fixed deposits (1.5-2% interest, with varying lock-in periods).

That way, you can adeptly balance short-term gratification (holidays and retail therapy) and long-term goals (such as owning a house by the time you reach 30).

What you need is flexibility in your investment options. Yes, long-term investments can be set aside for a rainy day, but keep in mind the changing nature of economic conditions and invest too in short-term tools that help you meet your financial objectives.

Kenanga Digital Investing (KDI) offers investors this flexibility with its KDI Save and KDI Invest products. While KDI Save is a zero-fee cash management product that boasts fixed 3% interest with daily returns, KDI Invest invests in a diversified portfolio of U.S. ETFs (exchange-traded funds) using Artificial Intelligence and machine learning.

By fully automating the investment process, the KDI Robo-advisory is making professional money management affordable and transparent, while taking out the emotional human element from the decision-making process. Head on to KDI Invest today and set up your risk profile in less than two minutes.