What’s Your Return on Investment?

There is no one query that is more integral to the choices of every potential investor than this: what is the Return On Investment (ROI)? This important term tries to directly measure the amount of return on a particular investment, relative to the investment’s costs.

It can help you to evaluate the yields of an ongoing investment – which is useful in helping you decide whether that particular asset is worth keeping, bolstering, or letting go. You can also use ROI to estimate the potential return on an investment opportunity so as to decide if it is worth your time, money, and effort.

ROI is such a commonly-used term nowadays that it no longer refers only to the consideration of a business investment; nowadays, people use it to mean the level of enjoyment they would derive from attending a party, watching a movie, or even taking on a new job. But this kind of common usage doesn’t always mean that everyone who uses the term actually knows how to calculate the ROI of their investments.

It is a key metric for helping you make informed choices for your portfolio, and can be a useful tool in helping you to avoid making impulse investments. Thus, it is in your best interests to understand when ROI is helpful and to find a simple method to use when calculating it.

When is ROI helpful?

ROI can be used to measure the profitability of any type of investment asset, such as whether to buy a stock or to buy into a business. It is best used when comparing different investments of the same type – which means that it is a good way to compare stocks to other stocks, though you might run into some confusion if you try to compare stocks to a property.

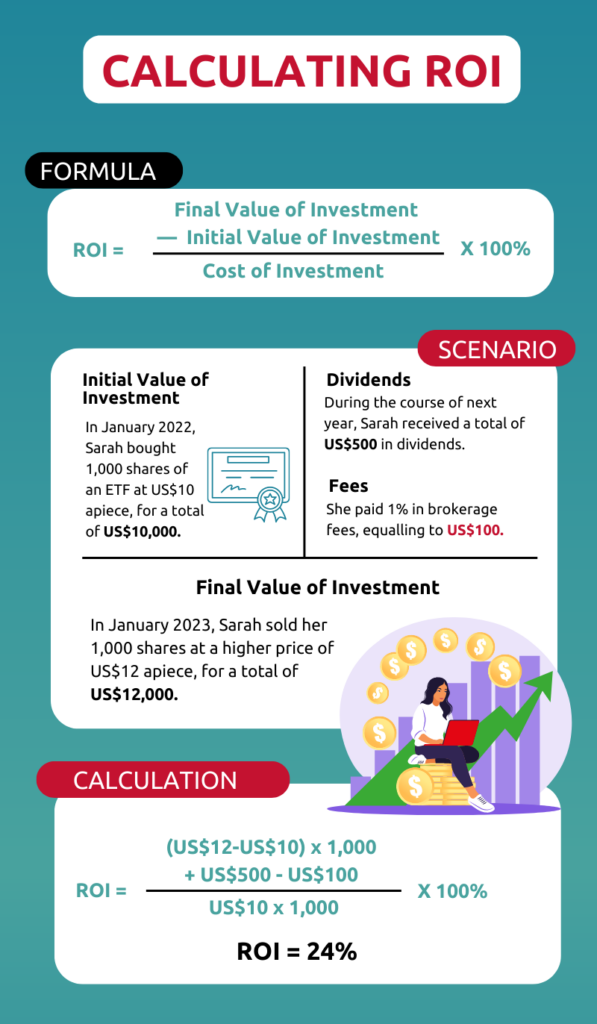

The basic formula is fairly simple, but its simplicity itself can cause problems. During the calculation, you have to pay careful attention to make sure that you account for all costs and gains of the investment throughout the time period in which you hold it.

Simply divide the value of the investment asset by your initial investment amount. For example: when calculating the ROI of your shares in a particular stock, the dividend payout is the gain, and the transaction fee is the cost. Of course, if you end up selling your shares, the gain would include dividends received plus profit (or loss) on the selling price.

Meanwhile, the ROI of a rental property must account for the rent amount as a gain, and the other overheads – including property taxes, repairs, and insurance – as costs.

Calculating ROI

Investopedia has an informative article that walks you through different ways to calculate ROI and interpret it. Below, we will demonstrate one of the simpler calculations to use so that you can get a feel for the type of calculation – without getting lost in the numbers.

ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally multiplying it by 100 to express it as a percentage. Turning the ROI into a percentage is important as it will make it easier to understand and interpret, especially when comparing investment classes.

Advantages and Disadvantages of ROI Calculations

The advantages of using ROI are that it is easy to calculate, applies to all types of investment assets, and gives you a percentage value that is easy to understand as a measure of profitability. Knowing even a simple calculation method means that you can quickly make decisions about assets in order to choose what works for you based on your risk preferences.

A major disadvantage, however, is that the calculation does not adjust for risk or the holding period of the asset; this means that the percentage you arrive at can be wildly different from reality, due either to something significant happening (such as a total supply chain collapse) or even to far less complicated reasons (such as not being diligent, which leads to making avoidable mistakes when factoring in all potential costs and/or gains).

Make it easy for yourself with KDI

KDI Invest is an algorithmic robo-advisory tool that matches your portfolio to your investment style and risk tolerance – so, you don’t have to worry about calculating the ROI yourself. This data-driven approach ensures that the investments made are what you would choose for yourself.

KDI Invest also has ultra-low annual (not transactional) fees, which makes it easier for you to plan ahead and ensure that most of the returns go straight into your pocket.

The transparency and accessibility of this tool via both smartphone and website means that you can check your ROI anytime, anywhere.

All it takes is RM250 to start your KDI Invest account – and as the Artificial Intelligence-driven app does the hard work of looking for the best ROI, all you need to do is sit back and relax.