Active vs Passive Investing

If you’ve been on Youtube, it’s a near guarantee you’ve seen an ad by “star investors” or fund managers who claim to be able to “beat the market”. You may also have seen ads teaching you how to “play the market” like a pro.

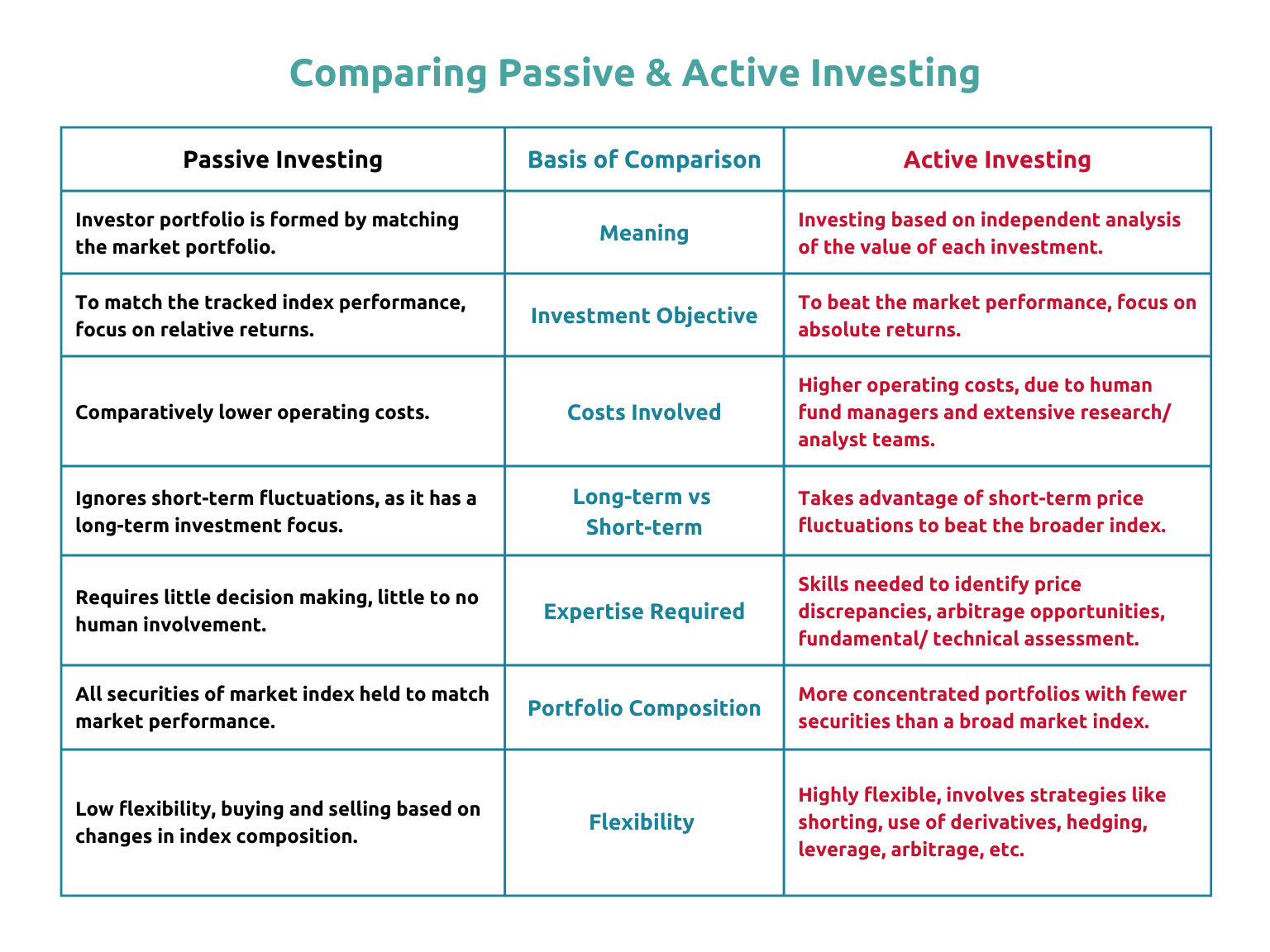

These strategies are often employed by active investors, who typically trade specific stocks or assets (stock picking) with the goal of beating average index returns. Active investing requires a hands-on approach, typically by a portfolio manager or other so-called active participant.

Alternately, passive investing involves less buying and selling and often results in investors buying index funds or other mutual funds. Passive investors typically try to match market returns, instead of beating the market.

Though active investors may beat the market one or two times, these “wins” are hard to replicate. Over the long-term, passive funds have historically done better than active. Year after year, the evidence against stock picking accumulated as the technology to automate buying and selling to match an index got better. Fewer than 15% of active U.S. large-capitalization funds beat the market over the past decade, according to 2020 data from S&P Global.

Even Warren Buffett, the so-called Oracle of Omaha, an active investor himself, advocates passively investing in index funds: “In my view, for most people, the best thing to do is owning the S&P 500 index fund,” said Buffett in May 2022.

Active Investing

Active investing enables more customisation for investors, giving them the ability to narrow down into specific stocks or sectors. Active investing also has a higher potential to ‘beat the market’ – although, as mentioned, this doesn’t happen often.

Moreover, active investors can hedge with options or short stock to produce windfalls that might increase the odds they beat indexes. These also, however, can greatly increase the costs and risks associated with active investing, so it’s best to leave these techniques to the pros.

Conversely, active investing exposes you to trends, whether they are meme stocks (GameStop) or pandemic-related stocks (Zoom). The important thing is knowing when to exit, whether your trend is fading or still holding strong. Otherwise, you could be left with a lot of losses when other investors dump the stock or in the case of Zoom, return to in-person meetings.

Another reason active investing rarely beats passive investing is the high fees and expenses due to active funds employing teams of human analysts who conduct extensive research. So it’s not enough to just beat the index — the manager has to beat the fund’s benchmark index by at least enough to pay the fund’s expenses.

Passive Investing

Passive investing involves investing in passive index funds, which are structured to replicate a certain index’ performance. An index fund often has the same composition of stocks as its benchmark index. With no human staff to employ, passive funds charge lower fees.

Passive funds remove emotion from the investment process and add transparency, in that you know exactly what stocks and how much of each your fund will be holding. On the other hand, because of its pre-set asset selection, passive funds have less flexibility in stock selections and do not typically outperform the market.

The Best of Both Worlds

While active investing has the allure of “winning” or “beating” the market, the average investor does not have the time, skill, nor energy to track global financial and economic news on a daily basis. Thus, passive investing is the way to go for long-term investing.

Robo-advisor KDI Invest offers the best of both worlds: passive investing’s benefit of low fees (up to 0.7% depending on amount invested) and no human intervention. Its artificial intelligence (AI) algorithm performs smart selection of diversified equity-traded funds (ETFs), enabling them to enjoy some of the pros of active investing (such as picking asset types) while adjusting for appropriate risk.

KDI Invest also offers investors some personalisation in their holdings, as upon signing up they will be sorted into one of five different types of risk profiles. Check out KDI Invest at https://digitalinvesting.com.my/invest/