Anticipating Your Money Packet: Smart Financial Moves for Cash Windfalls

One of the many wonderful things about Malaysian culture is the little packets of free money we receive during major holidays. Whether it is ang pao during Chinese New Year or duit raya when celebrating Hari Raya, it is a fun tradition that is enjoyed by all.

The only problem is that after you get to a certain age, you can’t just run off to buy sweets with the little kids…

Now, you’re old enough to know that money isn’t really free, and to feel the desire to make it last longer – but spending an unexpected cash windfall is a temptation that is hard to resist! Luckily, there are ways to spend your duit raya so that you can get the satisfaction of spending it AND gain the added benefit of positively impacting your long-term financial goals.

You can use the money to invest in future-proofing your life by starting an investment account, or by paying off a small debt that is best resolved sooner than later. If you have already been working hard to grow your financial portfolio, then consider investing in self-care. Burnout is a very real and debilitating condition that can throw you off your goals in many significant ways.

Just make sure to avoid buying something that does not appreciate in value, or to spend it all immediately without thought. The regret you will feel later will far surpass the momentary enjoyment – and you don’t need that kind of emotional baggage weighing you down.

Future-proof first

Future-proofing is making a plan or purchasing a good that makes your life easier in the future – or at the very least, it will not become an obstacle. If you get enough duit raya packets, you could make a small change to your life today that can have huge positive benefits in the coming years.

Utilise the time-honoured method of writing down the Pros and Cons of putting the money towards something you really want, so that you can see if it is good for you.

Ask important questions such as: Is it enough to totally pay off the rest of your car loan? You will benefit so much more from clearing off that loan early – plus, your vehicle allows you freedom of movement, where not having to worry about being able to afford it will give you a measure of enjoyment and independence that is useful.

Are you exhausted? Take a break! So many people are pushing themselves to the brink of exhaustion – but working smart is a lot better for you than working hard. Burnout is a lot more insidious and damaging than you can imagine – and spending your cash windfall on self-care is a smart investment towards your best asset: yourself.

Do not overindulge

So you piled all the packets together and counted out the money – and now your eyes are flashing with all the shiny, fancy things you could get. Do not immediately spend that money, no matter how tempting. Spending it recklessly will impact your current financial situation – even if you never expected it nor budgeted for it.

Above all else, think things through. Something that may seem like a good financial move at the moment may not be smart for the future. For example: do not spend the windfall as a downpayment on something new. It might seem like a good idea to use it to purchase something you couldn’t afford before – but if you can’t buy it outright (even with the duit raya packet’s help) then you are just taking on extra debt.

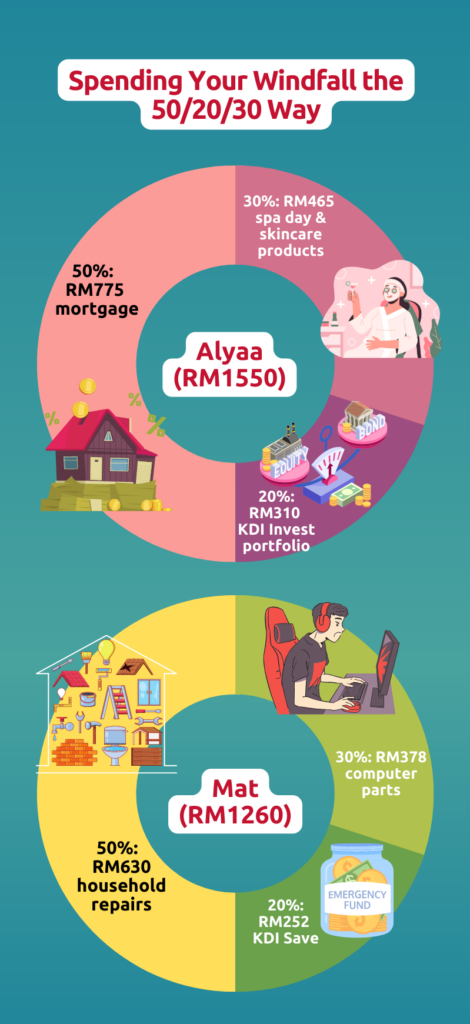

Do take note that extreme deprivation is not smart either; you could end up spending way too much just from the pressure of always denying yourself nice things. As such, spend a percentage of the money on something fun and save the rest. A good rule of thumb is the 50/20/30 rule, which is useful in managing everyday spending too. Generally, you spend 50% of the money on something you need, 30% on something you want, and save 20% for the future. That way, you can spend money responsibly while still also getting some enjoyment out of it.

A Lifetime Investment Journey Begins with KDI

After you spend your fun money, it’s time to ensure your future wealth with KDI Invest, a robo-advisor that builds an investment portfolio of U.S. exchange-traded funds (ETFs) for you based on your personal risk preferences. Bank Negara Malaysia (BNM) recommends planning for retirement regardless of age, so it is never too late to start building up your nest egg. Perhaps the need to use the 50/20/30 rule leads you to finally start an investment portfolio. The future always gets here a lot sooner than we anticipate – and you really do not want to find yourself regretting the choices that will leave you with a less comfortable life than you deserve.

Alternatively, you can put your savings in KDI Save, which offers a 3.5% effective annual rate. If you add on to your KDI Save whenever you get a bonus or other windfalls, the snowball effect of all that interest will compound and give you a tidy emergency fund should the need arise. With fixed daily returns and no locked-in period, KDI Save gives you higher returns and way more flexibility than the typical fixed deposit or savings account. Check out both KDI Invest and KDI Save today at https://digitalinvesting.com.my/