Investing in Your 50s: Focus on Retirement

There is still time to build up your savings. Take a deep breath and read that again. Sure, starting your investment portfolio in your 20s would have been great but sometimes life doesn’t work out exactly as we want it to. Now, you have the advantage of hard-earned experience and a very clear idea of what you want your future to look like. This will make a key difference in helping you build a portfolio that matches your needs.

Investing at this age is very similar to starting in your 30s in that it is goal-oriented, but you have to narrow your focus a lot more. Take some time to think clearly and objectively about your current situation and what you want to preserve about it into retirement. This will help you identify your goals and make it easier to know what you need to achieve them.

Sometimes we don’t even know what we don’t know! This is where the internet comes in handy, as all you need is to find a retirement calculator such as this one from the Private Pension Administrator Malaysia to help you find out your ideal retirement age and the amount of savings you will need.

Prioritise Yourself

You need to start prioritising yourself. This will require a shift in your mindset where you have to put your own needs ahead of other people’s needs and wants.

Working to establish a stable retirement for yourself is a gift that you are giving to your children as well. They will not have to worry about your health and well-being and the associated costs while trying to build their future.

Safety in Diversification

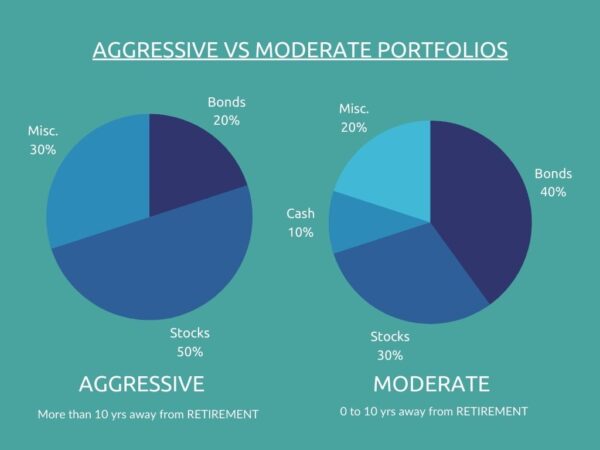

We all hear the word ‘diversify’ when it comes to investing, but it is not always clear what it means. Diversification is a technique in investing that helps to reduce your risk. When you diversify, you are spreading out your investment over various financial instruments and categories, thus reducing the amount of loss you may face due to an unexpected event.

There are different ways to diversify such as by diversifying across asset classes. This means that within the budget you allocate to a particular asset, such as stocks or bonds, you assign different amounts to various categories within that asset class. These separate categories may perform differently under different market conditions, so even if one category suffered a loss, other categories may remain stable or generate higher returns.

In essence what you want to do is create a moderate-risk portfolio that will not be subject to wild changes during periods of market volatility. You might have to wait a minimum of five years or longer to see the kind of returns you want to ensure a comfortable retirement, but this is the best way to ensure that you achieve comfort and maybe even a little luxury.

Moderate-risk portfolios are great for people who have a long-term goal they must achieve and cannot afford to make high-risk aggressive investments. At this stage in your life, moderate should be the most amount of risk you are willing to take if you do not have a lot of savings to fall back on if an aggressive investment style backfires.

Retire in Style with KDI

KDI’s A.I.-driven platforms make investing for your retirement easier, faster and more efficient through KDI Invest and KDI Save.

KDI Invest has a very affordable initial investment of RM250, and the recurring minimum investment amount is RM100. It has one of the lowest fees, and if your investment amount is RM3,000 and below, there are zero fees.

This instrument is a good way to start investing as it will help you to become more financially literate. This will give you the confidence to diversify your portfolio further and have a higher chance of meeting your retirement goals.

KDI Save is a savings account that will earn you daily returns on your savings with no management fees or lock-in period. With returns that outperform most fixed deposit returns, you can start your saving journey with KDI Save from just an initial deposit of RM100, and every subsequent top-up is at RM10.

If you want to make your money work for you, you can always move your KDI Save funds to KDI Invest. This robo-advisor builds you a portfolio consisting of US-listed exchange-traded funds (ETFs) while factoring in your risk profile. Your portfolio will be driven by the amount of risk you’re willing to take as well as the duration within which you want to see returns.