Know Your Net Worth

Net worth is a term we often hear in connection with very wealthy individuals — think Forbes Richest lists — so it might seem like you don’t meet the wealth criteria to calculate your own net worth. But everyone has a net worth, you just need to learn how to calculate and grow it. For instance, pre-pandemic in 2019, the average Malaysian had a net worth of RM48,429.

If your goal is to become a high-net-worth individual, then you must be financially savvy and one of the ways to do that is by understanding how to make your money work for you. Finding out your net worth can help you understand your spending habits, identify impulsive expenditures that you can cut off, and help you learn why you never seem to have enough money at the end of the month.

Your very own financial report card

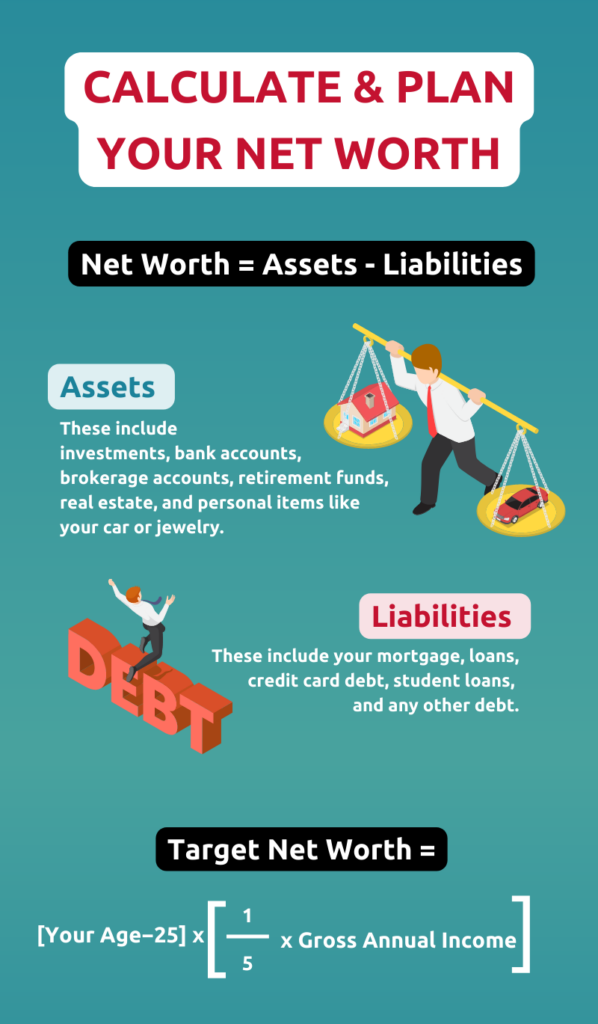

According to Investopedia, your net worth is the amount by which your assets exceed your liabilities. It gives you a tangible number to evaluate everything you’ve earned and spent up to the day you calculate it. Think of it as a report card for your finances, as it not only lists everything you own and owe, it also tells you whether those things are worth keeping. Yes, that means letting go of your beloved old car if it spends more time in the workshop than on the road!

Your assets are the things you own which have a ready cash value, such as a fully-paid-off house and car, a healthy investment portfolio, bank accounts, and even your diamond engagement ring.

Your liabilities are all your debts. If your house is still under mortgage, it is a liability since it costs you money. Credit card debt, student loans, and even the money you spend on luxuries (such as multiple streaming services) count as liabilities as well.

Regularly calculating your net worth allows you to keep on track or improve your financial status or help you find and follow a structured plan to improve your situation.

Calculate your net worth

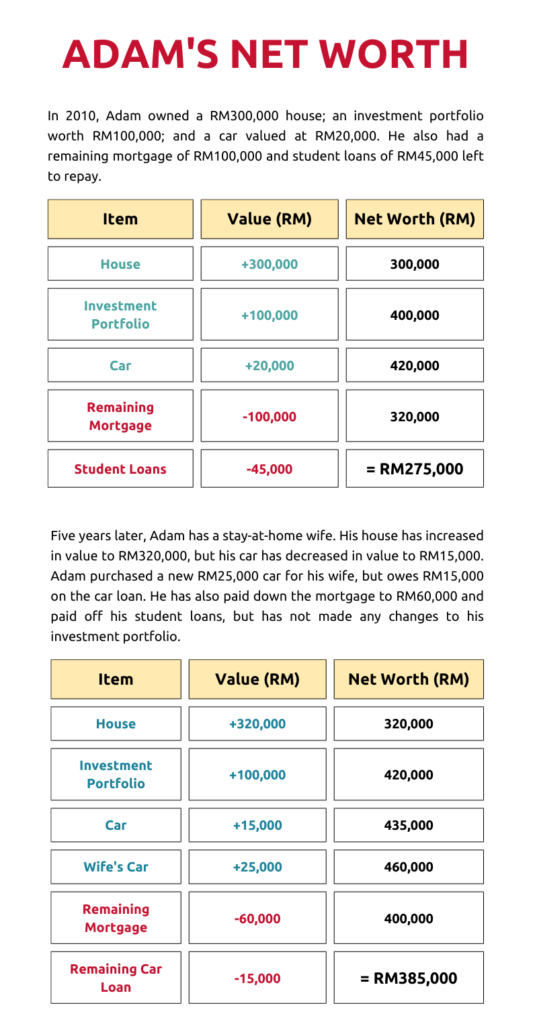

Before you begin, make a comprehensive list of your assets and liabilities. Be brutal in determining what goes under which column in the list. The more practical you are with yourself now, the better it will be for your future financial health. Once this is done, subtract your total liabilities from your total assets. Here’s an example of how to calculate your net worth and how your net worth can change as the years go by:

In five years, Adam’s net worth grew by RM110,000. By expanding his investment portfolio with tools such as KDI Invest, he could have an even better net worth.

Positive vs negative net worths

A positive net worth means you are managing your finances well. It means that your loans do not exceed your ability to pay them off, giving you a little extra to invest and spend as needed. A positive net worth is a base figure that you must refer to regularly, as your net worth should increase over time. However, if your net worth remains positive but does not show an upward trend, you may have to take a hard look at the way you are managing your money.

A negative net worth means that your spending exceeds your earnings. Even if you still have money to spend, if your overall net worth shows that you owe more money than you earn every month, you are in a very serious financial predicament. Negative net worth is not necessarily a sign of financial irresponsibility, as your net worth can fluctuate based on your income and expenditures.

During the pandemic, many people experienced a reduction in their salary while their rent and expenses remained the same. Others who relied on their year-end bonus to fund investments or pay fees, were forced to dip into savings or borrow money when the much-needed bonuses were cancelled.

Don’t let anyone tell you that there is an ideal number that is the “perfect” net worth for everyone. Each person and their financial needs, wants, and obligations are different – and so their target net worth will be different as well. Perhaps reaching your target goal will give you access to a higher standard of living and thus, you may need to set a different target to maintain it afterwards.

Some people work towards a specific net worth so they can afford a comfortable life for their children, others do it so they can afford to take a leap of faith into entrepreneurship. Calculating your net worth right now gives you a great starting point for knowing what your ideal net worth should be for the life you want to lead.

Growing your net worth with KDI Invest

KDI Invest is a robo-advisory tool that uses algorithmic investing to provide you with superior portfolio management via exchange traded funds that have reliable market behaviour. This A.I.-driven tool can be programmed to match the investments to your personal risk tolerance level and it automatically rebalances your portfolio to offset market volatility to maximise your returns.

In these uncertain economic times, your earnings and expenditures may fluctuate to rhythms of life that are out of your control. With KDI Invest, you can count on steady earnings that rely solely on data that is uncoloured by emotions (like fear or euphoria), which could risk your financial future. Sign up for KDI Invest today at https://app.digitalinvesting.com.my/registration/signup or download the Kenanga Digital Investing app from the Apple App Store or Google Play Store.