Protecting Your Investments Against Inflation

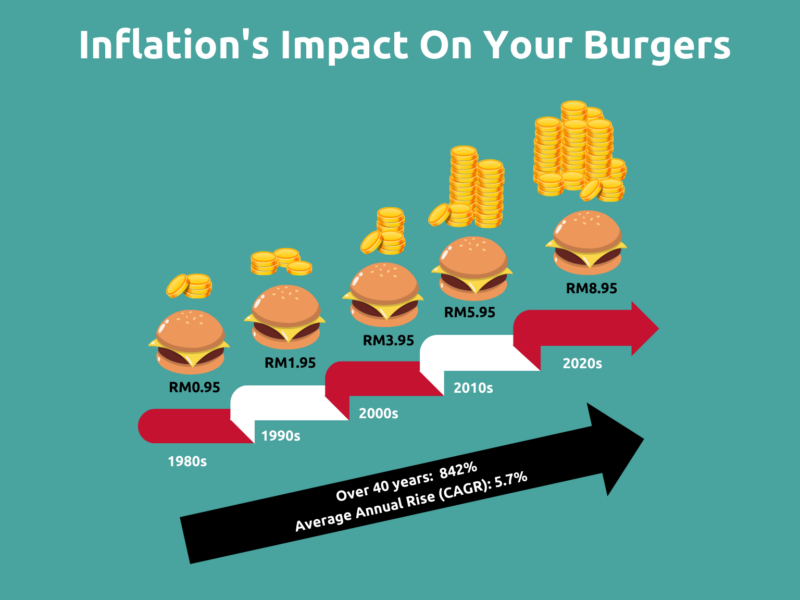

Every year your wages (if you are lucky) go up by maybe 3%, and yet every time you do your grocery shopping, get a burger, or watch a movie, it feels like you are getting less and less bang for your buck.

You complain to your local coffee shop because your favourite drink prices are rising every year, and each time you complain the proprietor tells you it is because petrol is more expensive, or that minimum wage is up so they have to pay their workers more.

These are all small incremental effects of inflation on your wallet – and eventually your savings and investments. Inflation is essentially how much your purchasing power (i.e. what you can buy for the same amount of money) declines over time.

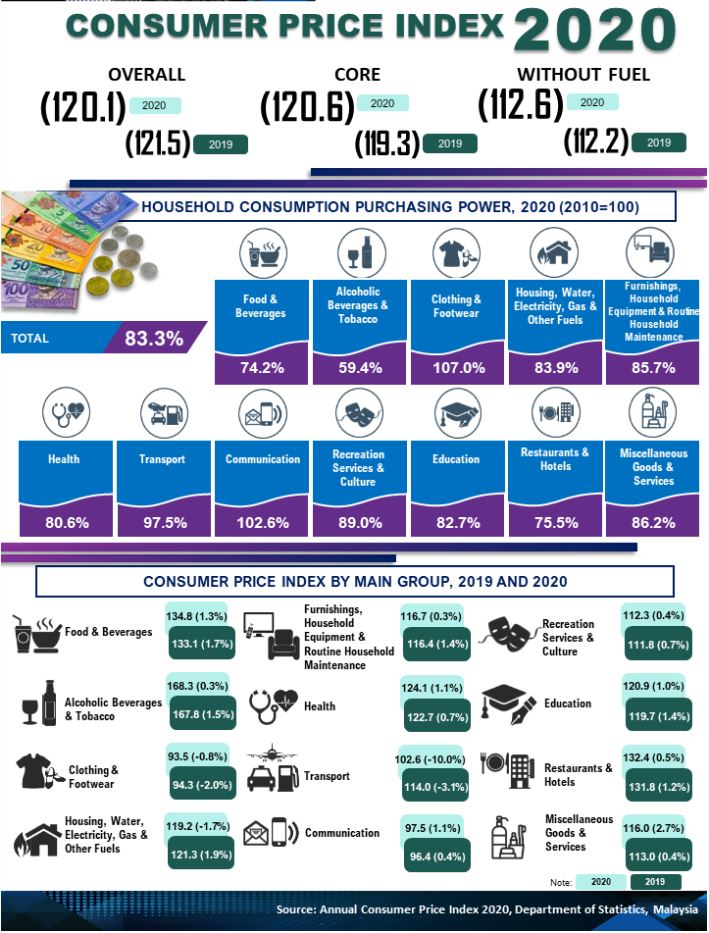

Local statistics departments typically report inflation rates on a monthly basis using Consumer Price Index (CPI). CPI raises of 1-3% every month have been common in Malaysia over the past few decades and 2021 full-year CPI rose 2.5%.

While the individual items are not specified, the Department of Statistics Malaysia (DOSM) derives CPI by tracking prices across 12 major consumer groups including food, clothing, utility bills, transport and healthcare.

Sometimes, prices of key goods decline instead of rise and this is called deflation. This typically happens in tandem with lower wages and weaker economies such as in the pandemic year of 2020, when Malaysia’s inflation rate declined 1.2%.

Nonetheless, DOSM still found that over a 10-year period between 2010 and 2020, CPI had risen 16.7%. This means that RM100 that you had in 2010 could only buy RM83.30 worth of goods in 2020.

Why Should You Care About Inflation?

With wages stagnating and inflation rising, simply keeping your money in cash or in low-risk and low-interest savings accounts is not enough: you are still going to lose real investment value over time. For instance, if you are setting aside money for your retirement and plan to live on RM5,000 when you retire in 30 years, that RM5,000 may not be enough. Its real value might be equivalent to RM2,500 today, with inflation affecting cost of living such as food, petrol, and grocery prices.

High inflation can seriously impact real value appreciation. Even if your investments are bringing in 10% returns over a period of time, if inflation grows 8% at the same time, your real investment value growth would only be 2%. So what can you do to stop inflation from eating into your long-term investments?

Inflation Myths & How To Save Smart

In many Asian households, a common refrain is to invest in so-called ‘recession-proof’ or ‘inflation hedge’ products that will continue to appreciate over time, such as gold or real estate.

However, both these alternative investment products require some finesse: you need to buy at the right time or at the right place. If you had bought gold in 2012 when prices were at US$1,800 per ounce instead of 2016 when it was US$1,100, you would only be making 11% more at today’s prices of US$2,000. That’s lower than the inflation rate of 16.7% so you would still be losing value.

Thus, for investors who do not have the time nor expertise to keep tracking commodity prices and following up on investment news, such investments are more trouble than they are worth.

Another common low-risk recommendation for investors looking to hedge against long-term inflation is Treasury Inflation-Protected Securities (TIPS), a type of bond indexed to inflation that is backed by the U.S. government. However, TIPS’ low-risk nature and ability to protect your principal investment also means low returns (sometimes lower than typical bonds). If a typical bond return is 4-5% annually, TIPS will be lower at 2-3%, so do not put all your savings into it.

The best hedge against inflation is to diversify your investments into different asset types with differing returns and risk levels such as bonds, equities, commodities, and real estate. If your investment horizon is longer, the probability of you losing real value is lower.

If you are too busy to stock pick or craft an investment strategy across different products and investment managers, do not resign yourself to the age-old method of keeping your money under your mattress. Likewise, consider using products other than low-yield savings accounts or fixed deposits (FDs).

Assuming Malaysia’s inflation rate of 2.5% persists over the coming years, you will still lose real value if you keep your money in savings accounts that commonly return less than 1% annually.

Even higher-yielding FDs of 1.85-2.85% require investors to jump through many hoops to hit the higher end (spend thousands on your credit card, invest hundreds of thousands, and save several thousands a month). Even then, you will be barely making above the inflation rate.

Instead of low-interest, FD products, why not look at Kenanga Digital Investing’s KDI Save, which guarantees fixed returns of 3% per annum for investment of up to RM200,000. Beyond that, the return will be 2.25%. With no lock-in period (investors can withdraw anytime) and zero fees, this is an ideal savings product for your rainy day or emergency funds.

Hassle-Proof Inflation Hedging With KDI Invest

For long-term income investors, the question remains: How do you beat inflation while diversifying your asset allocation without the hassle of personally selecting when to buy and sell each asset?

KDI Invest allows you to do so by building your portfolio using a combination of Exchange Traded Funds (ETF). There are many types of U.S. ETFs: bonds, industries, commodities, currencies, and even TIPS!

As to when and how to exit or reallocate your portfolio, you do not have to worry about tracking market movements or going through the hassle of selling and buying assets. As a robo-advisor, KDI Invest’s leverages the data-rich environment of the U.S. ETFs, and its AI detects and automatically rebalances customer portfolios depending on your selected risk profile.

Whether you want a low-risk guaranteed-return product for your short-term savings needs (KDI Save) or a diversified higher-risk product for long-term income investing (KDI Invest), KDI solves all your inflation-hedging problems. Click here to start investing with KDI now!