Fundamental Analysis: How It Makes Your Portfolio Sing

Time and technology has made investing accessible for everyone – but not every single aspect of the investment spectrum is relevant to the individual investor. If you just want to ensure that your retirement is comfortable, or that your child does not have to compromise when it comes to their education, then you do not need an expert-level understanding of every feature of the investment field.

However, knowledge is always useful – and you never know how something you learn today can help you make better choices tomorrow. Plus, it can be hard not to worry about your investments when you’re a regular person and not one of the 1% who can lose on a speculative bet, and still be comfortably well-off. Learning more about the investment world can give you a greater sense of security regarding your portfolio, and give you a better idea of what questions to ask when choosing the right products and people to help you manage your portfolio.

With this in mind, let’s learn the basics of fundamental analysis. This article will define Fundamental Analysis, identify how it differs from technical analysis, and what it is most often used to evaluate (stocks).

Understanding Fundamental Analysis

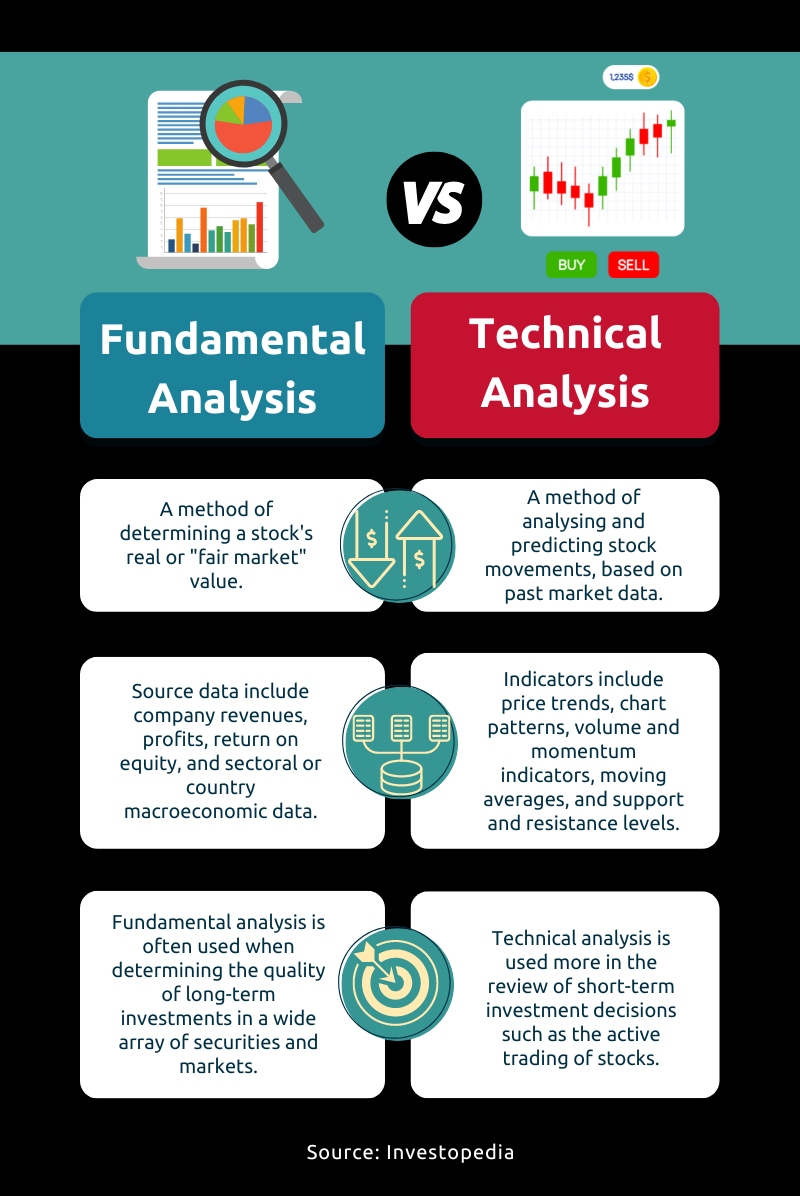

Fundamental analysis refers to techniques used to determine the fair market value of a stock. This fair value is determined by assessing the economic and financial factors that are connected to the product: the related company’s revenue versus profits; annual reports; investment rates; the stability of the economy in which the company operates in; etc.

This evaluation allows fundamental analysts to arrive at a “target” price that they can compare to the current price in order to determine whether the stock is overvalued or undervalued. Basically, if the stock is determined to be selling at a price lower than its intrinsic value, then fundamental analysts would recommend buying it. If it is selling for higher than its estimated value, they would recommend not buying any more, or even selling what you have.

Fundamental analysis is easy to follow in many ways, because it uses publicly available financial records shared by companies (such as their annual reports which often detail company-wide changes to management, financial choices that were made, and the resulting effects of those choices).

The reported profit margins, the plans for future growth, and the consistency of a company’s earnings all give fundamental analysts a clear idea of how stable that company’s stock is as an investment asset. Keep in mind that fundamental analysts are reliant on the financial information as reported by the company to create the metrics that compare it within its field.

What About Technical Analysis?

Technical analysts prefer to study historical trends of an investment product to identify patterns. These patterns are then used to make predictions. This means that technical analysis is about forecasting the future behavior of an asset by analyzing how it has behaved in the past.

These analysts create indicators by looking at past prices and volumes, as well as the movement of these over a given period of time. These indicators are then depicted as patterns (examples include: head and shoulders, symmetrical triangles) which will inform technical analysts of investor and trader behavior.

Technical analysis is more often used for short-term investment decisions, such as in daily active trading of stocks. Fundamental analysis can be more reliable in determining if specific stocks or markets are worth investing in for the long-term.

Why Does Fundamental Analysis Matter?

The assumption behind fundamental analysis is that the price at which a stock is selling might not be its Intrinsic Value. Knowing this value allows investors to buy stocks with better odds of increasing in value over time, generating them a significant profit.

The only problem is knowing exactly how long to hold on to the stock, as the long-term can mean weeks, months, or – more likely – years. It relies on understanding not just the facts and figures about a company, but also the quality of it.

Fundamental analysts have to ask questions like:

● Does the company have a sustainable business model?

● Has the company shown a steady growth in gaining competitive advantage in the field?

● Is the company in a fast-growing or established or declining industry?

This is the downside of fundamental analysis. It can be very subjective and if an analyst does not have the determination to build a deep understanding of the company beyond what it self-reports, then the analysis they share is shallow.

Streamline Your Path to Future Wealth

As you can see, the jargon can hide pretty straightforward information. And while this is all nice to know, the independent investor who just wants to grow a healthy portfolio doesn’t really need to get into the nitty-gritty of fundamental or technical analysis.

KDI Invest removes the need to learn a whole new set of skills off your shoulders, so you can just concentrate on growing your future wealth. The robo-advisor focuses on U.S.-based exchange-traded funds (ETFs) with reliable market behavior. This algorithmic investing tool evaluates ETFs with a variety of fundamental, technical and economic factors to choose the right product for you in the current market environment, according to your risk profile.

Kickstart your wealth accumulation journey and sign up for KDI Invest online or download the Kenanga Digital Investing app on the Google Play or Apple App Store today!