Navigating Economic Uncertainty Using Market Data

These past few years have left us shaken. Institutions we believed to be steadfast have proven fragile – and as a society, we are all seeking stability and certainty. We want to be sure that every step we take is the right one for us.

Instagram posts and motivational speakers can say that money can’t buy happiness – and it is true; having money is not going to change the way we see the world.

Nonetheless, possessing a healthy reserve of ringgit will make it easier for us to navigate the world. Money allows us to move toward a future where we can take care of our wants as well as our needs; it gives us a cushion to fall back on during lean times, and it gives us the option of taking breaks so that we do not burn out – these things add up to a life where you have the ability to pursue happiness.

As such, economic uncertainty can put fear into the heart of any investor, and may incite you to make unnecessary emotion-driven choices. In an uncertain world, the best anchor is information. If you want to feel secure about your financial future, it is time to look into the data.

Look into the history of your investment company, financial advisor, or the assets in your portfolio, as well as how well they have handled themselves over time. How did the investment company get to where it is today? Who is your financial advisor, and what is their track record over time? How have the different asset classes performed during the last 15, 10, or even five years?

Conservative or high-risk approach

The data that applies to your needs depends on your approach to investing. The conservative approach would be to invest in “set time” horizon-specific assets. This is better for more risk-averse people who have a very clear objective – such as their retirement, or their children’s education – as their primary goal.

The conservative investor will benefit best from seeking out a financial advisor or utilising a robo-advisory tool that is guided by Artificial Intelligence (A.I.), depending on their preference towards being guided.

Financial advisors can provide evidence for the health of different investment assets, which they will then use to guide your choices. Robo-advisors use up-to-date information and A.I.-driven algorithmic investing, and can be programmed to take your risk tolerance into account. Both of these options will give peace of mind to the conservative investor, as they know that their preferences are predominant to the process.

The high-risk approach works for young people who have time to recover from risky speculations that go wrong, or for affluent investors with the resources to invest in multiple assets.

Investors who believe they have a high tolerance for risk should seek out information on what risk in investing really means. High-risk takers must be careful to ensure that they are following their investment thesis rather than being drawn in by excitement when considering where to spend their resources.

Both types of investors still need a diversified portfolio, as no one should rely solely on one asset class – no matter how reliable or exciting – to provide for their future wealth.

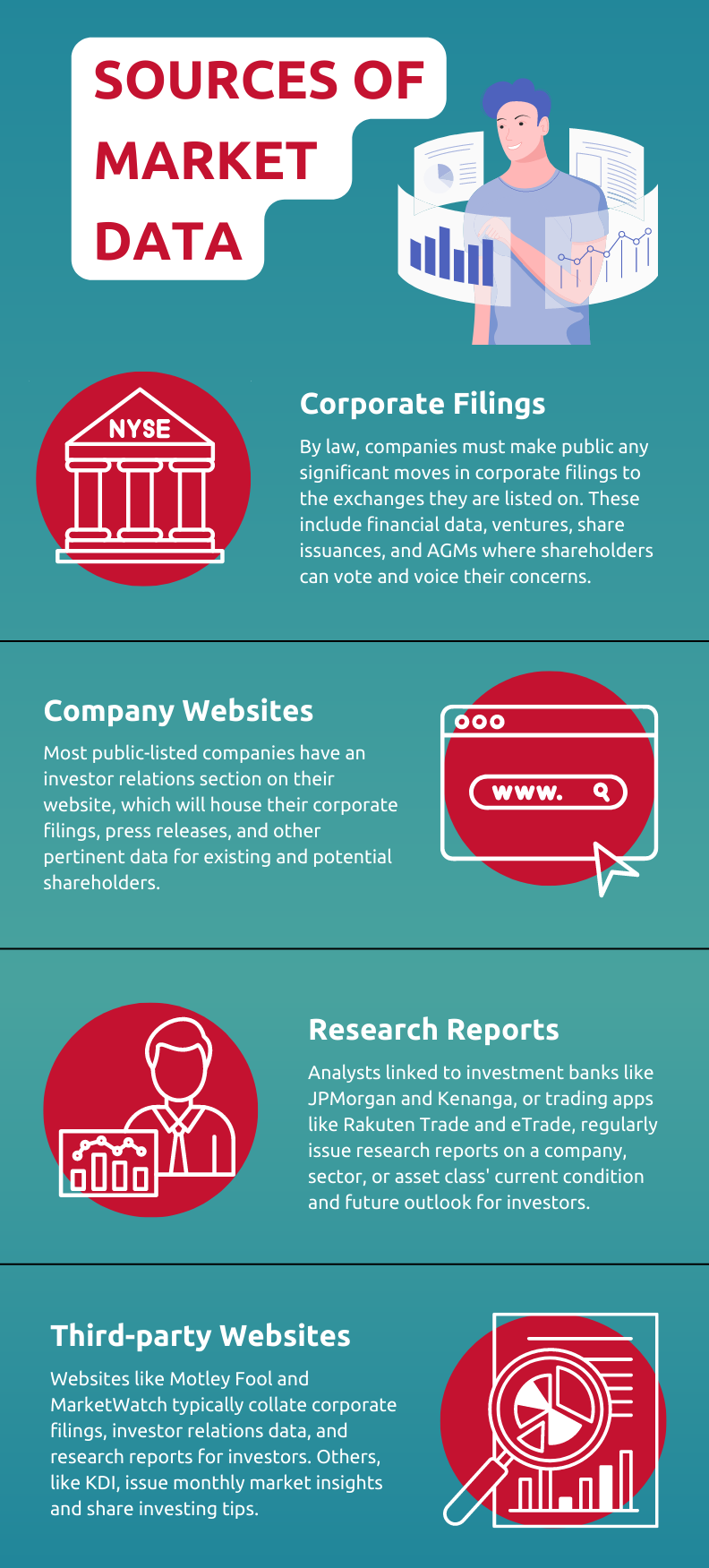

Finding reputable data

There are several ways to collect the information you need to ensure that your money is in the right hands – and not all of these routes require you to have an advanced degree in information technology or research practices.

Choosing the right information source ensures that you are receiving actual information, not fluff pieces or unverified opinions from non-credible sources. Newspaper articles with sensational headlines predicting doom and your school friend’s uncle who “has a Wall Street friend who gave him a good tip” are extremely unreliable sources.

Instead, look for corporate filings which can be analysed so that you can keep track of how the company is managing its financial and manpower resources, and whether it has managed to easily meet – or even exceed – projections.

Financial websites such as Investopedia and Kenanga Digital Investing (KDI) offer information to help guide people so that they can make informed choices. These websites also explain what terms mean, how to find out what you need, and offer investment avenues you can explore.

Minimise uncertainty by utilising KDI

KDI Save is a short-term strategy to guarantee that your money grows while you take the time to do the research you need to decide on other investments. Offering higher interest rates than a regular FD account assures you of fixed returns every day.

KDI Invest is for the long-term. This robo-advisory tool offers the best of both worlds: smart selection of diversified exchange-traded funds (ETFs) while adjusting for your risk tolerance as needed, when needed.

Why U.S.-traded ETFs? The largest variety of ETFs are listed on U.S. exchanges and are operating in what is called a “liquid market” where they are bought and sold easily due to high trading volumes. It is also a data-rich market, which allows KDI Invest’s A.I. to continuously improve its predictions.

Uncertainty will always dog your investment journey – but all it takes is RM100 to open a KDI Save account or RM250 for a KDI Invest account to lessen the impact of the risks, whatever strategy you decide to undertake.