What to Do During a Sluggish Economy

Now is not a great time for taking risks. The global economy and supply chain are still in the recovery phase, as disruptions from the COVID-19 pandemic have proven slow to dissipate. Even governments and corporations have been forced to continue some of the new adjustments that they had to adopt in order to manage the upheavals.

Prices are high; businesses are closing or consolidating by reducing outlets; and exciting new financial products that were supposed to be the future (e.g.: cryptocurrency) have proven to be very shaky. In our daily lives, our Ringgit is just not stretching as far as it used to and everyone is feeling the pinch. Right now, the only thing we can be sure about is that the economy is sluggish, and that we must avoid financial risks.

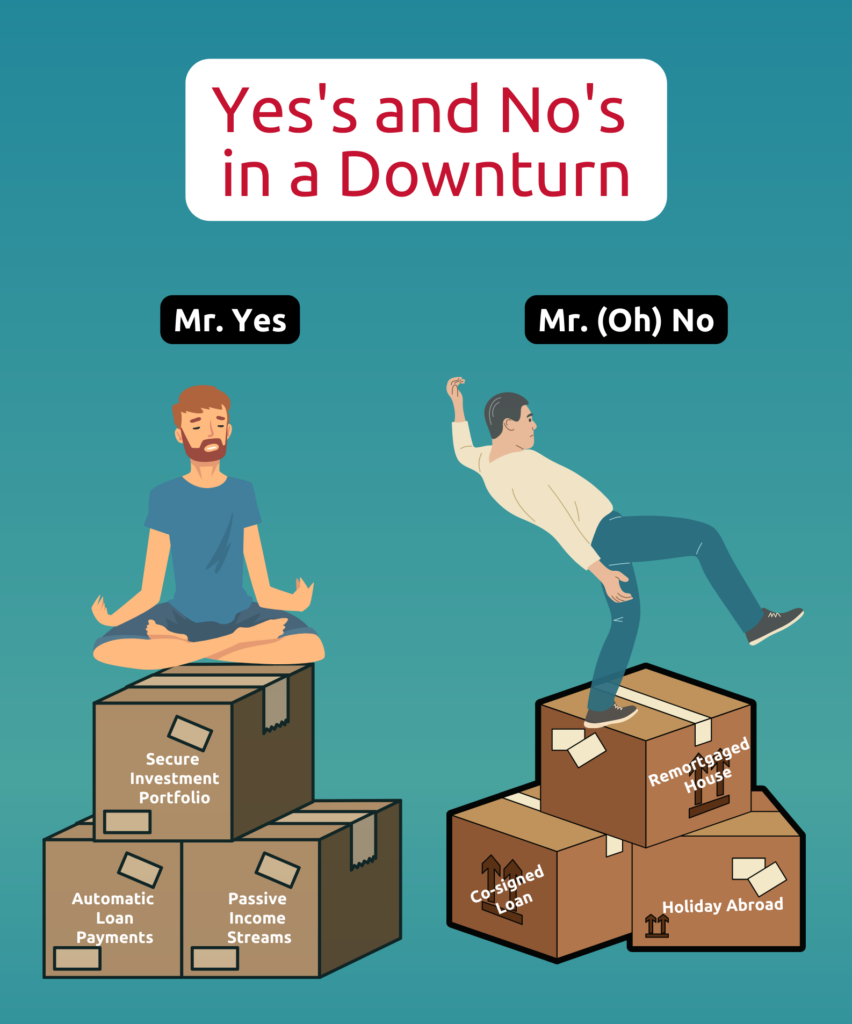

Say “NO” to new debt

Now is not the right time for being in debt. Of course, there is nothing much you can do about the debts you currently have, other than to prioritise paying them off. The thing you must not do is take on any new debt. Let us repeat: DO NOT take on new debt, whether this means co-signing for someone else or obtaining a new mortgage for yourself.

It may be flattering that someone thinks you’re such a reliable person that they want you to co-sign their debt – but flattery is not a tangible benefit. Co-signing on someone else’s debt means that you will be liable if they fail to make payments.

Likewise, perhaps you have always promised to help your kids when they eventually need a car or house – but this economy is the time for hard financial lessons all around. If you absolutely cannot say no, it might be better to make a gift of money as a downpayment towards what your kids want, rather than putting yourself at risk of losing more than you can afford.

It can be really hard to avoid temptation right now because companies are bombarding you with great deals for homes, vehicles, new appliances, etc. These businesses are trying to make money to recoup their losses; they are in a much better state for recovery than your individual net worth. If you cannot be a hundred percent sure of your income, or you still have other debts pending, no deal is good enough to risk losing everything.

The only time that spending money is a good idea is on courses or training workshops that can make you more valuable in your current field. This will likely make your employer reluctant to let you go, and could improve your prospects for bonuses and promotions; conversely, it could also make you a better candidate for more lucrative job opportunities with other companies.

Say “YES” to new income

If you haven’t already, now is the time to start exploring passive income options. After all, if you must spend money, it is better for it to go towards making more money for yourself.

Over the past year, large and seemingly stable corporations such as Facebook (Meta) have laid off thousands of employees. This is in addition to the thousands who were laid off or retrenched due to the pandemic. It means that there are a lot of opportunities for different kinds of small businesses to blossom and grow – businesses that can offer retraining in new fields; career guidance; boutique/specialised services that companies can hire contractually to provide for the staff losses.

Even if your job is secure, you can still take advantage of the opportunities out there for passive income. Job security is actually the best resource you can have when laying down the groundwork to start adding extra income avenues, such as an online business or expanding your investment portfolio.

Say “NO” to risky investments

There is no doubt that investing is smart – but do not let your fears make you take unnecessary risks that could harm your portfolio. Always think of your investment portfolio as your future wealth. It future proofs your retirement years, and ensures that you can have the peace of mind and comfort that you are working so hard to look forward to.

Caution applies to both your investment portfolio and any passive income streams you have. Do not take on any investment products that require you to borrow money or spend more than you can comfortably afford. And yes, if that “sure-thing” your cousin’s friend from work is pushing you to try sounds like an MLM, it is definitely an MLM – say NO!

If you want to put your money into a small business, it might be better to start your own rather than making a direct investment in someone else’s small business. This allows you to know exactly what’s happening with your money, and to grow it at the pace that suits your temperament. Also, growing your business cautiously will pay off in the long term more than if you make flashy investments without a solid return on investment (ROI). Learn more about the different levels of risk involved for both traditional and alternative assets here.

Invest in the future with KDI

This is the time to cultivate a healthy level of caution towards unnecessary risks. Re-focus on your financial goals for the future by identifying your short- and long-term needs so you can distinguish them from your wants.

One of the best ways to recession-proof your life is to invest for the future. KDI Invest is a robo-advisor that utilises algorithmic investing and continuous machine learning to respond to market moves in near-real-time by rebalancing your portfolio, protecting you and your future wealth.

If you want a solution for more immediate financial worries, then build-up an emergency fund with KDI Save. This is exactly what you need to start up an emergency fund, as it is a liquid, low-risk investment product that gives you daily returns and does not lock-in your money, allowing you to withdraw whenever the need arises. Find out more at https://digitalinvesting.com.my