DTI: Understanding Your Debt-to-Income Ratio

Sometimes, it can feel like people are throwing financial jargon around just to sound smart. This may make you reluctant to seek out details about these terms – but the illusion of complexity will only last till you start your research. Some of these acronyms are important for your financial goals – and the Debt-to-Income Ratio (DTI ratio) is a pretty significant one.

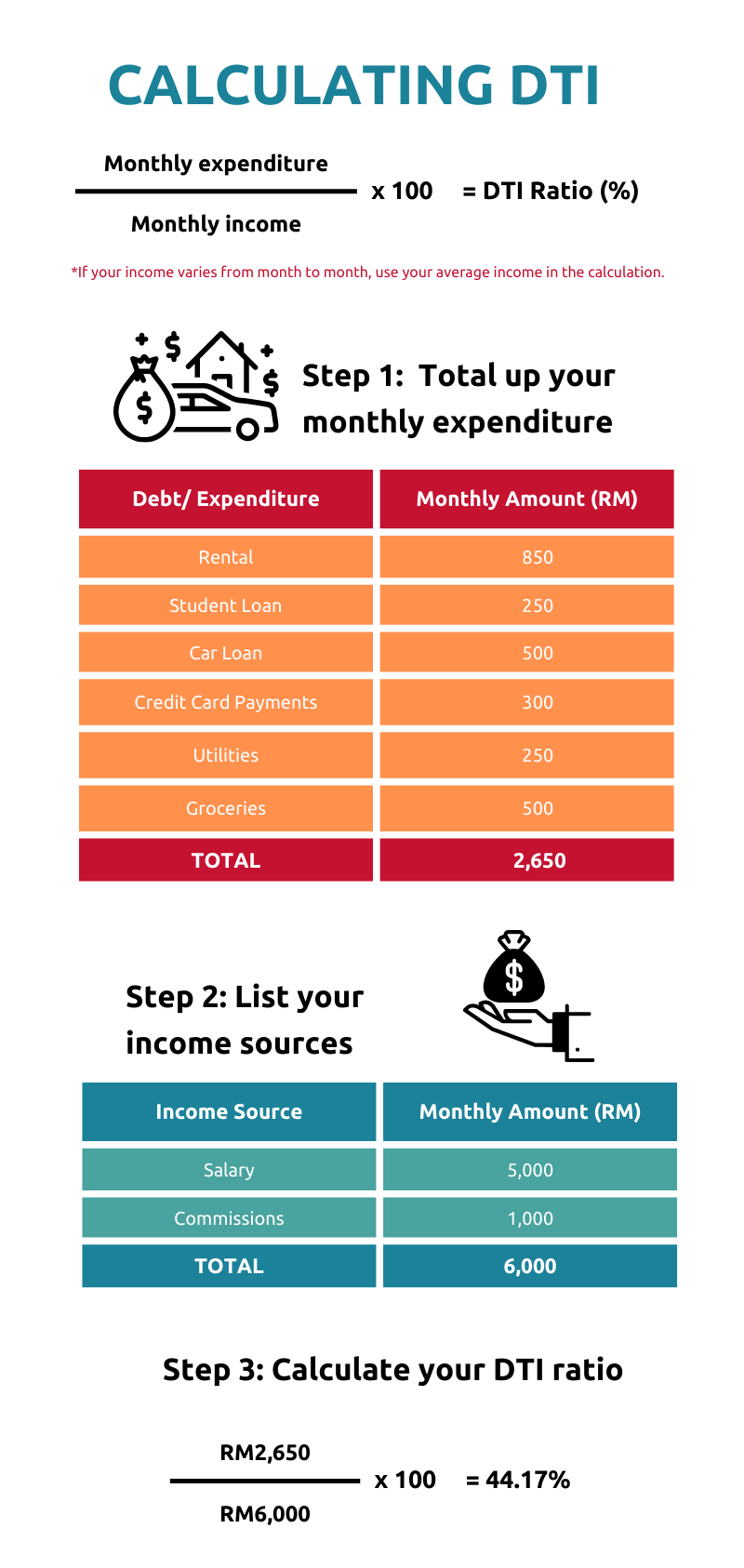

Calculating your DTI ratio can give you an idea of where you stand financially. Comparing the amount of debt you have against your total income informs you about your capacity for big expenditures.

A high DTI ratio indicates that you need to buckle down, stick to a tighter budget, and focus on paying off your loans before making any big purchases. A low DTI ratio is a good indication that you are managing your finances well, and can risk making a large expenditure (such as buying a house).

Why do you need to know your DTI ratio?

A good DTI ratio can help you achieve your financial goals much more smoothly. For example, in Malaysia, an acceptable DTI ratio is 30%, so anything above this number will make you a high-risk applicant for a loan.

Thus, knowing your DTI ratio will help you to plan better and get a clearer picture of how your financial health looks to banks, insurance providers, and other financial institutions. Another way to find out your credit score, and to set a baseline for improvement, is to get your credit report from the Central Credit Reference Information System (CCRIS) under Bank Negara Malaysia.

Knowing this, you can plan future investments, reorganise your investment portfolio to more accurately provide for your future financial needs (such as paying for your children’s education or setting yourself up for retirement), and identify debts to prioritise for repayment to make you a better candidate for a loan.

Calculating your DTI ratio

Due to the importance of this ratio to financial health, there are many resources you can use to calculate your DTI ratio, including this simple calculation suggested by MyGovernment or this version from Investopedia.

Less debt or a higher income would give you a lower and better DTI ratio. Given the illustrated scenario, If you pay off your student loan in full but make no other changes, your DTI ratio would be reduced to 40.83%. If your salary increases by RM1,000 but everything else stays the same, your DTI ratio would narrow to 37.86%.

Reducing your DTI ratio with KDI Save

KDI Save offers you zero management costs and no lock-in periods which means that you can withdraw your money as needed. This allows you to make a real impact on your DTI ratio by clearing debts such as credit card payments or car loans within a reasonable time frame.

Clearing debt is a sure-fire method to lowering your DTI ratio. Plus, KDI Save which has a better rate (3.5% effective annual return as of October 2022) than many fixed deposit (FD) accounts, allows for a higher return within the same period of time while also accruing daily returns.

For your future wealth goals, there is KDI Invest. This A.I.-driven robo-advisory invests in U.S.-based exchange-traded funds (ETFs) with reliable market behaviour, giving you a diversified selection of assets that respects your risk profile. Utilising data-driven algorithmic investing techniques, your portfolio will respond and rebalance to the market with the speed and emotion-free logic that only a well-designed machine can deliver.